Sukanya Samriddhi Yojana Calculator

Published on Mar 04, 2023

Sukanya Samriddhi Yojana Calculator

Sukanya Samriddhi Account ( Girl Child Prosperity Account) is a Government of India backed saving scheme targeted at the parents of girl children. The scheme encourages parents to build a fund for the future education and marriage expenses for their female child.

Sukanya Samriddhi Yojana (SSY) was introduced from FY 2014-15, Under the scheme interest is applied on minimum closing balance between 10th and last day of the month and interest is compounded annually. Click Here for Scheme features

SSY Calculator Table and Chart

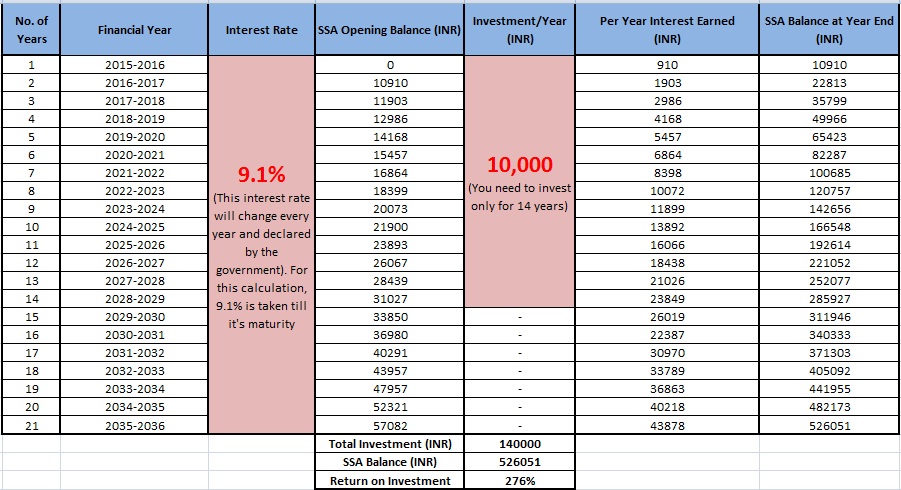

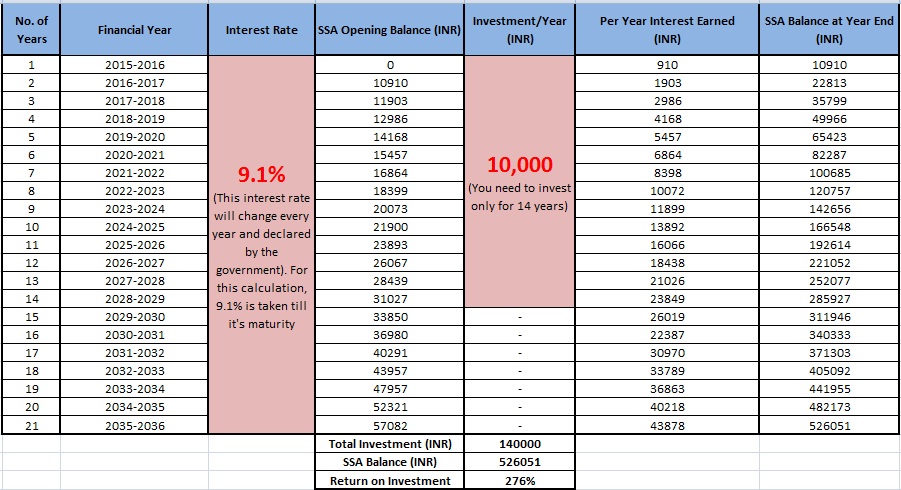

SSY Year Wise Balance and Interest Calculator - You can calculate SSY account interest and balance at the end of each Financial Year from FY 2015-16. Interest calculations of future periods are based on current interest rates.

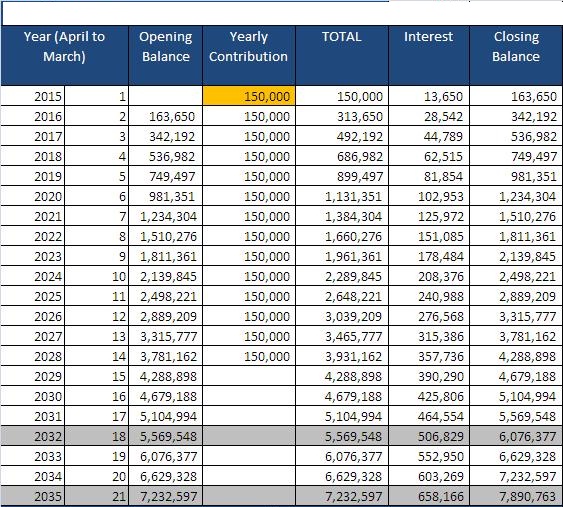

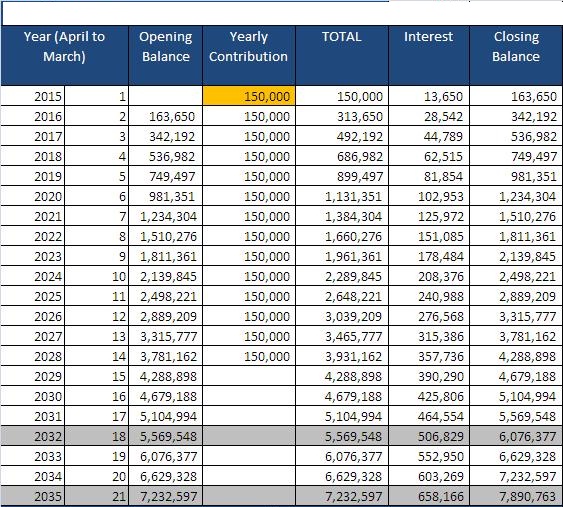

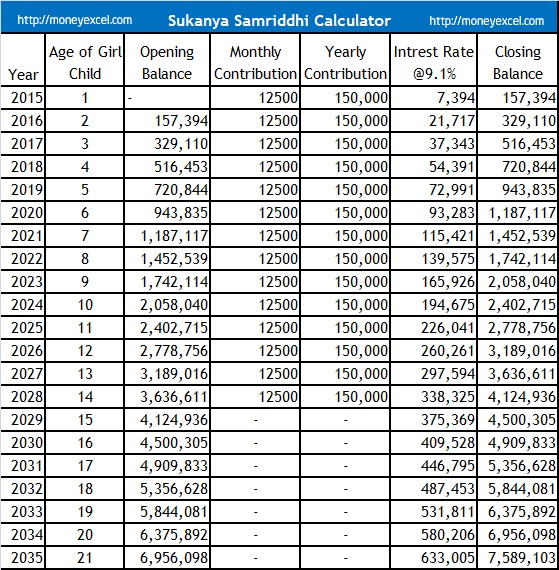

Monthly Contribution Rs. 12,500

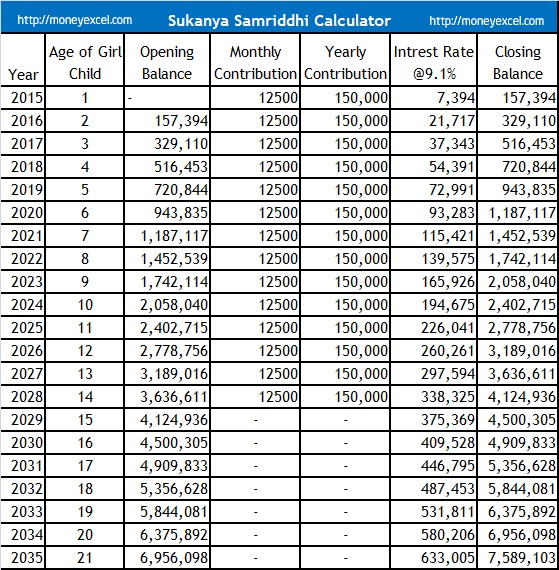

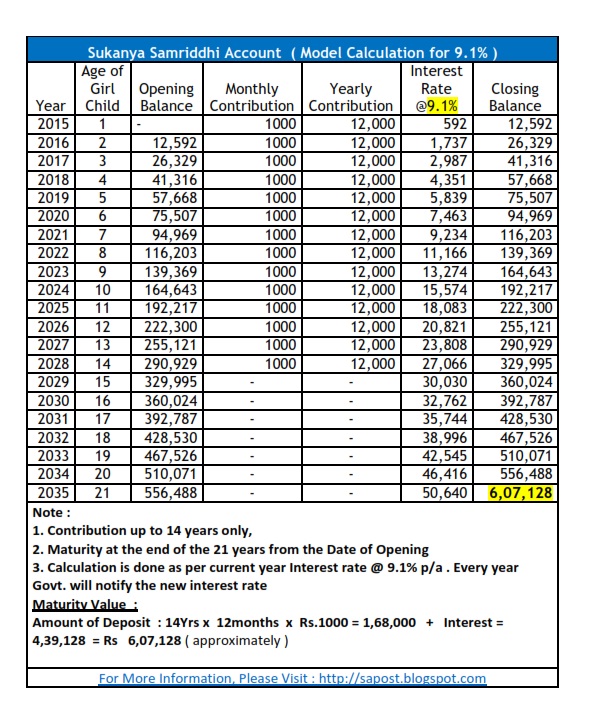

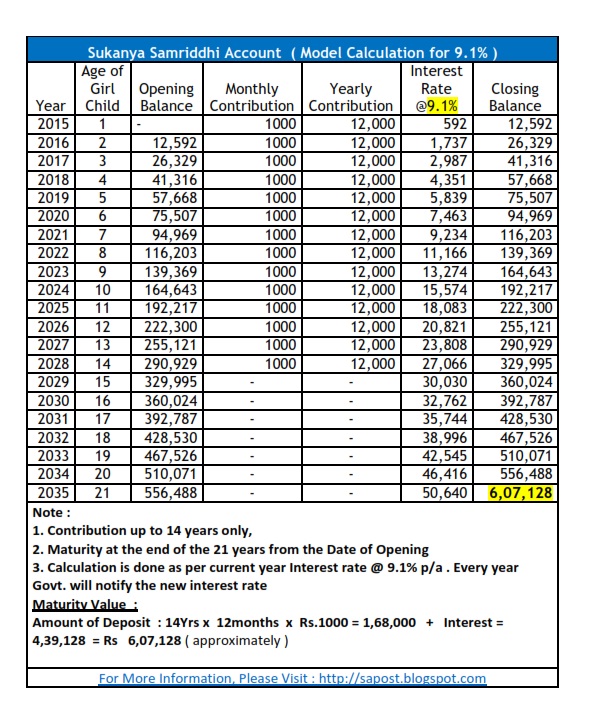

Monthly Contribution Rs. 1,000

The following calculators commpiled in view of various options of investment available in the scheme which are based on the presumption that the monthly investment is made on or before 10th of every month and the calculations of Interest and maturity value after 21 years are based on current interest rates.

Interest Rates Revisions

Tax Benefits

At the time of launch, only the deposits in the account were eligible for tax deduction under Section 80C of the Income Tax Act, which is Rs 150,000 in 2015-16. However, Finance Minister Arun Jaitley announced, during the 2015 Union Budget, tax exemption on the interest from the account and on withdrawal from the fund after maturity, making the tax benefits similar to that of the Public Provident Fund. These changes were applied retrospectively from 1 April 2015. These benefits will be reassessed annually

SSY Closure on Maturity Rules 2016

(1) The Account shall mature on completion of a period of twenty-one years from the date of its opening: Provided that the final closure in the Account may be permitted before completion of such period of twenty one years, if the account holder, on an application, makes a request for such premature closure for reasons of intended marriage of the Account holder and on furnishing of age proof confirming that the applicant will not be less than eighteen years of age on the date of marriage:

Provided that no such premature closure shall be made before one month preceding the date of the marriage or after three months from the date of such marriage.

(2) On maturity, the balance including interest outstanding in the Account shall be payable to the Account holder, on an application by the Account holder for closure of the Account, and on furnishing documentary proof of her identity, residence and citizenship.

(3) No interest shall be payable once the Account completes twenty-one years from the date of its opening

Premature Closure Allowed only in these Scenarios

• If parent or guardian intentionally arrange a marriage after the girl child attains the age of 18 years, then need to file an application before 1 months of marriage or after 3 months of marriage along with her age proof documents.

• Girl child pass away on production of death certificate and balance in the SSA will be paid to the guardian.

• If girl child becomes non-resident or non-citizen of India, then this status shall be communicated by the girl child or guardian within 1 months.

• After completion of 5 years, if Post office or bank satisfied that operation or continuation of SSA is causing an undue hardship to the girl child (such as death of guardian or medical emergency etc.) may arrange for early closure.

• For any other reasons, if SSA to be closed any time after the opening of SSA, then it will be allowed, but the Whole deposit could make interest rate applicable to post office savings bank

More Topics:

Epass Status Delhi ,

Epass TN Government ,

Gujarat Ration Card List 2019 2020 ,

Gujarat Ration Card List 2020 Online Apply ,

Hand Sanitizer Gel Formulation PDF ,

Happy Easter 2020 Stickers for Whatsapp and Facebook,

Happy Vishu 2020 Stickers in Malayalam for Whatsapp and Facebook,

How To Register For Special Flights To India ,

Interstate Travel During Lockdown ,

Jio Fiber in Alappuzha - Plans, Price, Offers, Customer Care Alleppey,

Jio Fiber in Idukki,

Jio Fiber in Kannur,

West Bengal Bevco ,

What is HHD Number in PMJAY in Hindi ? ,

What Is PMSBY in Canara Bank ,

www-cee-kerala-gov-in ,

www.esic.in ,

www.esic.nic.in Recruitment 2020 ,

www irctc co in When Train Booking Open Date,

www.mera.pmjay.gov.in New Registration ,

www.mera.pmjay.gov.in Registration Online 2019 2020,

www Mera Pmjay Gov Login in Hindi English ,

www.norkaroots.org Application Form ,

www.pmjay.gov.in Online Registration 2019 2020 - Login and Sign up,

www pmkisan .gov .in

More Topics:

http,

www.wb prochesta.gov.in ,

xseededucation.com ,

ysr rythu bharosa. ap. government. in,

https //irctc.co.in ,

https //irctc login ,

https //www.irctc.co.in login ,

https //www.irctc.co.in/nget/train-search cancellation ,

IRCTC ,

Jio Fiber in Kasaragod,

Jio Fiber in Kochi or Ernakulam Office,

Jio Fiber in Kollam,

Jio Fiber in Kottayam Office,

Jio Fiber in Kozhikode,

Jio Fiber in Malappuram,

Jio Fiber in Palakkad,

Jio Fiber in Pathanamthitta Office,

Jio Fiber in Thiruvananthapuram,

Jio Fiber in Thrissur or Trichur,

Jio Fiber in Wayanad,

LIVE ,

Lockdown Pass Rajasthan Download ,

Migrant Registration Service ,

My 2020 Covid 19 Time Capsule Ideas ,

NFSA Ration Card Gujarat

More Topics:

Norka Covid Support ,

Norka Online Registration Application Form ,

Norka Pravasi Registration ,

Norka Registration for Interstate ,

NORKA Starts Pravasi Registration for Expats ,

Norka Roots Org ,

Norka Roots Registration ,

Rajasthan E Mitra App Migrant Worker Ghar Wapsi,

Rajasthan Pravasi Registration ,

Ration Card Online Check Gujarat ,

Ration Card Online Gujarat ,

NORKA Roots Registration,

Registrationnorkaroots Org ,

serviceonline.gov.in Epass ,

sso.rajasthan.gov.in Register ,

tn e pass.tnega ,

TN Epass Application Status ,

TN E-Pass Status Check Online ,

UP Epass Online Apply Status Lockdown ,

UP E-Pass Status Check Online ,

Malayalam Stickers for Whatsapp, Facebook Funny Comments,

World Covid 19 Cases Table ,

Today's Gold Rate in Alappuzha,

Today's Gold Rate in Ernakulam,

Today's Gold Rate in Idukki

More Topics:

Today's Gold Rate in Kannur,

Today's Gold Rate in Kasaragod,

Today's Gold Rate in Kerala,

Today's Gold Rate in Kochi,

Today's Gold Rate in Kollam,

Today's Gold Rate in Kottayam,

Today's Gold Rate in Kozhikode,

Today's Gold Rate in Malappuram,

Today's Gold Rate in Palakkad,

Today's Gold Rate in Pathanamthitta,

Today's Gold Rate in Thiruvanathapuram,

Https Sevasindhu Karnataka Gov In Dams ,

https //sevasindhu.karnataka.gov.in login ,

https //sevasindhu.karnataka.gov.in/sevasindhu/english ,

https //www.qtoken.in ,

https //www.qtoken.in.com ,

https //www.qtoken.in /liquor/apply/ ,

Inter District Travel Pass Kerala ,

Interstate Travel Pass Karnataka ,

June Lockdown Extension ,

Karnataka 5000 Rs Scheme Auto Driver Cab Status Apply,

Karnataka Driver Yojana ,

Aryankavu Check Post Kollam ,

Ayushman Bharat Diwas ,

Ayushman Bharat Yojana List of Hospitals 2019 2020

More Topics:

jnanabhumi.ap.gov.in Inter Halltickets 2020,

AP Inter 1st 2nd Year Results 2020,

Nokia 5310 New Version Mobile ,

Nokia 5310 Reviews ,

Nokia 5310 Features ,

Nokia 5310 Specifications ,

Nokia 5310 India Launch ,

New Nokia 5310 Xpressmusic 2020 Price In India ,

Nokia 5310 New Mobile Price In India 2020 ,

New Nokia 5310 4g Price In India ,

Nokia 5310 Release Date 2020

More Topics:

Nokia 5310 Original Xpressmusic 2020 ,

Nokia 5310 2020 ,

Inter 1st Year Results 2020 AP,

AP Intermediate Results 2020 Date And Time,

AP Inter 2nd Year Results 2020,

https://bie.ap.gov.in/ Intermediate Results 2020 SMS Format,

APBIE Intermediate Results 2020,

bieap.gov.in 2020 Results,

How To Check Inter Results 2020 AP,

Manabadi Inter Results 2020 AP,

AP Inter Hall Tickets 2020 Download 1st Year,

bie.ap.gov.in Halltickets 2020 : APBIE Updates,

More Topics:

12th Kerala Board Result 2020,

IEXAMS DHSE Kerala App for Results in Play Store,

Class 12 Kerala Result 2020,

Plus Two Improvement Result 2020,

Higher Secondary Equivalency Exam Result 2020,

Plus Two Result 2020 Hsslive,

Kerala Higher Secondary Result 2020,

Kerala Plus Two Result 2020 Date,

www.kerala result.nic.in 2020 Plus Two Results School Wise,

Kerala Plus Two Result 2020 School Wise,

Kerala Plus Two Result 2020 Check,

DHSE Kerala Plus 2 Result 2020,

Kerala State Class 12 Results,

www.kerala result.nic.in Plus Two Result 2020,

dhsekerala.gov.in Plus Two Result 2020,

Second Year Result 2020 Kerala

More Topics:

Bihar Ration Card List 2020 Status www.epds.bihar.gov.in,

Temporary Ration Card E-Coupon Status for Delhi,

PUBG Mobile update 0.19.0 with Livik map now available for iOS and Android,

khadya.cg.nic.in CG New Ration Card List 2020 Online Apply,

Gujarat Ration Card List 2020 Online Apply,

www.foododisha.in Ration Card Status 2020 Odisha,

www.mahafood.gov.in Ration Card Status 2020 Maharashtra,

fcs.up.nic.in Ration Card List 2020 UP Status District Wise,

Maharashtra HSC Result 2020 Date at 15th July,

mpresults.nic.in 10th Result 2020,

www.mpbse.nic.in 2020 10th Result @ mponline.gov.in,

MP Board 10 Result Name Wise @ mpbse.nic.in,

MP Board 12 Result @ mpbse.nic.in,

Rajasthan BSTC Online Form 2020 @ www.predeled.com,

BSEB (OFSS) Intermediate (11th) Admission Merit List 2020-2021