Published on Mar 04, 2023

Sukanya Samriddhi Account ( Girl Child Prosperity Account) is a Government of India backed saving scheme targeted at the parents of girl children. The scheme encourages parents to build a fund for the future education and marriage expenses for their female child.

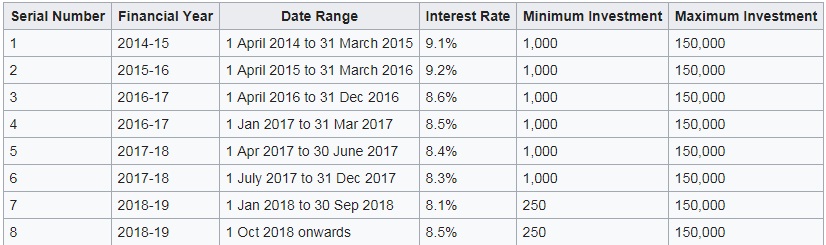

The central government launched the 'Sukanya Samriddhi Account' programme in January 2015 with an objective to promote the welfare of girl child. According to india.gov.in, 'Sukanya Samriddhi Yojna' is a small deposit scheme for girl child. Recently, the minimum deposit for this account has been slashed to Rs 250 from existing Rs. 1,000. This means that customers need to make a minimum annual deposit of only Rs 250 in this account now. A natural/ legal guardian on behalf of a girl child can open 'Sukanya Samriddhi Account'.

1. The account can be opened by the natural or legal guardian in the name of a girl child from the birth of the girl child till she attains the age of 10 years

2. A depositor can open and operate only one account in the name of a girl child under the scheme rules

3. Natural or legal guardian of a girl child can be allowed to open the account for two girl children only. The third account in the name of the girl child can be opened in the event of birth of twin girls, as second birth or if the first birth itself results into three girl children

o A legal Guardian/Natural Guardian can open account in the name of Girl Child.

o A guardian can open only one account in the name of one girl child and maximum two accounts in the name of two different Girl children.

o Account can be opened up to age of 10 years only from the date of birth. For initial operations of Scheme, one year grace has been given. With the grace, Girl child who is born between 2.12.2003 &1.12.2004 can open account up to1.12.2015.

o If minimum Rs 1000/- is not deposited in a financial year, account will become discontinued and can be revived with a penalty of Rs 50/- per year with minimum amount required for deposit for that year.

o Partial withdrawal, maximum up to 50% of balance standing at the end of the preceding financial year can be taken after Account holder’s attaining age of 18 years.

o Account can be closed after completion of 21 years.

o Normal Premature closure will be allowed after completion of 18 years/provided that girl is married.

1. SSY Account Opening Form

2. Birth Certificate of girl child

3. Identity proof (as per RBI KYC guidelines)

4. Aadhar card of Girl child (mandatory)

5. Residence proof (as per RBI KYC guidelines)

Investment in Sukanya Samriddhi Yojana scheme is exempted from Income Tax under section 80C. The scheme offers Tax Benefit under TripleE regimen ie. Principal, interest and outflow all are tax exempted

To meet the financial requirements of the account holder for the purpose of higher education and marriage, account holder can avail partial withdrawal facility after attaining 18 years of age

At the time of launch, only the deposits in the account were eligible for tax deduction under Section 80C of the Income Tax Act, which is Rs 150,000 in 2015-16. However, Finance Minister Arun Jaitley announced, during the 2015 Union Budget, tax exemption on the interest from the account and on withdrawal from the fund after maturity, making the tax benefits similar to that of the Public Provident Fund. These changes were applied retrospectively from 1 April 2015. These benefits will be reassessed annually

(1) The Account shall mature on completion of a period of twenty-one years from the date of its opening: Provided that the final closure in the Account may be permitted before completion of such period of twenty one years, if the account holder, on an application, makes a request for such premature closure for reasons of intended marriage of the Account holder and on furnishing of age proof confirming that the applicant will not be less than eighteen years of age on the date of marriage:

Provided that no such premature closure shall be made before one month preceding the date of the marriage or after three months from the date of such marriage.

(2) On maturity, the balance including interest outstanding in the Account shall be payable to the Account holder, on an application by the Account holder for closure of the Account, and on furnishing documentary proof of her identity, residence and citizenship.

(3) No interest shall be payable once the Account completes twenty-one years from the date of its opening

• If parent or guardian intentionally arrange a marriage after the girl child attains the age of 18 years, then need to file an application before 1 months of marriage or after 3 months of marriage along with her age proof documents.

• Girl child pass away on production of death certificate and balance in the SSA will be paid to the guardian.

• If girl child becomes non-resident or non-citizen of India, then this status shall be communicated by the girl child or guardian within 1 months.

• After completion of 5 years, if Post office or bank satisfied that operation or continuation of SSA is causing an undue hardship to the girl child (such as death of guardian or medical emergency etc.) may arrange for early closure.

• For any other reasons, if SSA to be closed any time after the opening of SSA, then it will be allowed, but the Whole deposit could make interest rate applicable to post office savings bank