Published on Nov 20, 2019

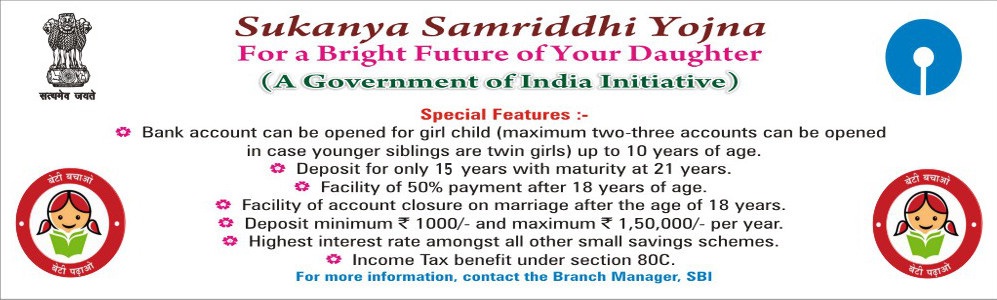

Pradhan Mantri Sukanya Samriddhi Yojana - Calculator, Chart, SBI : Sukanya Samriddhi Account ( Girl Child Prosperity Account) is a Government of India backed saving scheme targeted at the parents of girl children. The scheme encourages parents to build a fund for the future education and marriage expenses for their female child.

The scheme was launched by Prime Minister Narendra modi on 22 January 2015 as a part of the Beti Bachao, Beti Padhao campaign. The scheme currently provides an interest rate of 8.5% (for October 2017 to December 2017 ) and tax benefits. The account can be opened at any India Post office or branch of authorised commercial banks.

The scheme was launched by Prime Minister Narendra Modi on 22 January 2015 in Panipat, Haryana. The accounts can be opened at any India Post office or a branch of some authorised commercial banks. Initially, the interest rate was set at 9.1% but later revised to 9.2% in late March 2015 for FY2015-16. Interest Rate have been revised for FY 2016-17 to 8.6%.

The account can be opened anytime between the birth of a girl child and the time she attains 10 years age by the parent/guardian. Only one account is allowed per child. Parents can open a maximum of two accounts for each of their children (exception allowed for twins and triplets). The account can be transferred to anywhere in India.

A minimum of Rs. 250 must be deposited in the account initially. Thereafter, any amount in multiples of Rs 100 can be deposited. However, the maximum deposit limit is Rs 150,000. If the minimum deposit of Rs. 250, (initially which was 1000) is not made in a year, a fine of Rs. 50 will be put on.

The girl can operate her account after she reaches the age of 10. The account allows 50% withdrawal at the age of 18 for higher education purposes. The account reaches maturity after time period of 21 years from date of opening it. Deposits in the account can be made till the completion of 14 years, from the date of the opening of the account. After this period the account will earn only applicable rate of interest.If the account is not closed, then it will not earn interest at the prevailing rate. If the girl is over 18 and married, normal closure is allowed.

Of time, the interest of SSY will always be greater than that of PPF. For both, the government fixes the interest rate on quarterly basis dependent on the G-sec yields. The interest rate and spread that SSY enjoys over the G-sec rate of similar maturity is 75 basis points in comparison to PPF’s 25. The scheme currently provides an interest rate of 8.1% and EEE tax benefit.

At the time of launch, only the deposits in the account were eligible for tax deduction under Section 80C of the Income Tax Act, which is Rs 150,000 in 2015-16. However, Finance Minister Arun Jaitley announced, during the 2015 Union Budget, tax exemption on the interest from the account and on withdrawal from the fund after maturity, making the tax benefits similar to that of the Public Provident Fund. These changes were applied retrospectively from 1 April 2015. These benefits will be reassessed annually

(1) The Account shall mature on completion of a period of twenty-one years from the date of its opening: Provided that the final closure in the Account may be permitted before completion of such period of twenty one years, if the account holder, on an application, makes a request for such premature closure for reasons of intended marriage of the Account holder and on furnishing of age proof confirming that the applicant will not be less than eighteen years of age on the date of marriage:

Provided that no such premature closure shall be made before one month preceding the date of the marriage or after three months from the date of such marriage.

(2) On maturity, the balance including interest outstanding in the Account shall be payable to the Account holder, on an application by the Account holder for closure of the Account, and on furnishing documentary proof of her identity, residence and citizenship.

(3) No interest shall be payable once the Account completes twenty-one years from the date of its opening

• If parent or guardian intentionally arrange a marriage after the girl child attains the age of 18 years, then need to file an application before 1 months of marriage or after 3 months of marriage along with her age proof documents.

• Girl child pass away on production of death certificate and balance in the SSA will be paid to the guardian.

• If girl child becomes non-resident or non-citizen of India, then this status shall be communicated by the girl child or guardian within 1 months.

• After completion of 5 years, if Post office or bank satisfied that operation or continuation of SSA is causing an undue hardship to the girl child (such as death of guardian or medical emergency etc.) may arrange for early closure.

• For any other reasons, if SSA to be closed any time after the opening of SSA, then it will be allowed, but the Whole deposit could make interest rate applicable to post office savings bank