Published on Oct 24, 2018

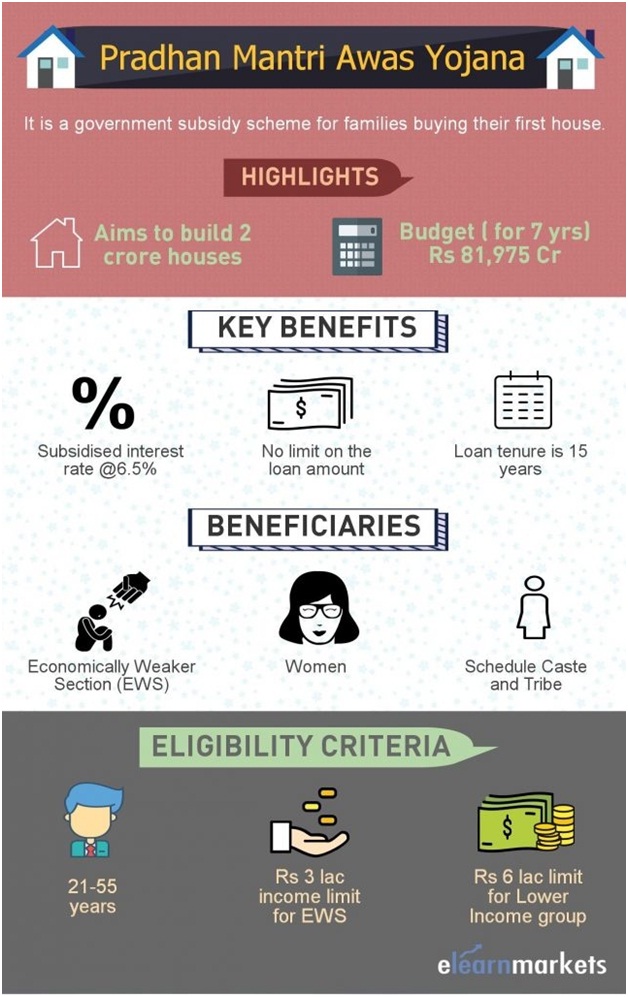

The "Credit Linked Subsidy Scheme” (CLSS) under pradhan mantri awas yojana (PMAY) was announced by our Honourable Prime Minister Shri Narendra Modi. The scheme envisages the vision of housing for all by the year 2022. ICICI Bank offers "Credit Linked Subsidy Scheme" under Pradhan Mantri Awas Yojana

• The primary objective is to provide pucca affordable houses to all by 2022

• This scheme aims to make registration compulsory so that the benefits can be availed by the female beneficiaries.

• The Government aims to monitor this scheme through end to end E-Governance model by using Awaas Soft and Awaas app.

• Another important objective is to include widows, transgender, lower income group people.

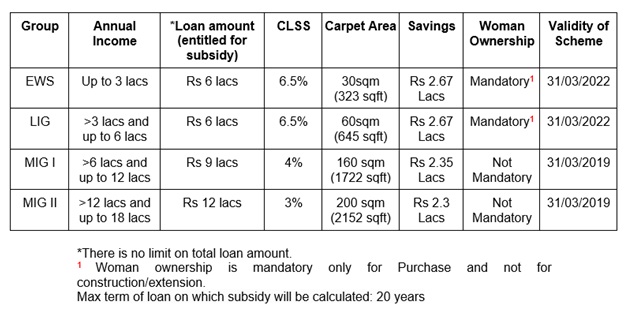

Under this scheme, interest subsidy on purchase/ construction/ extension/ improvement of house is provided to customers belonging to Economical Weaker Section (EWS)/Lower Income Group (LIG)/Middle Income Group (MIG).

• Upfront interest subsidy benefit on principal outstanding

• Aadhaar number(s) of the beneficiary family are mandatory for MIG category

• Interest subsidy will be available for a maximum loan tenure of 20 years or the loan tenure availed by the borrower whichever is lower

• There is no cap on the loan amount or on the cost of property.

• The Net Present Value (NPV) of the interest subsidy will be calculated at a discount rate of 9 %.

• The additional loan beyond the specified limits, if any to be at non-subsidized rate.

PMAY Scheme is made for Low-Income Group families (LIG), Medium Income Group (MIG) families and Economically Weaker Section (EWS), also if you fulfill the stated eligibility and if your family consists of husband, wife and unmarried children you can avail the PMAY benefits. Moreover the person who is applying should not own a house either in his name or in the name of any family member in any part of India.

The Income criteria are different for different groups such as:

1. Economically Weaker Section (EWS): Peoples whose income less than Rs. 3 lakhs come under EWS category.

2. Lower Income Group (LIG): Person with an annual income between Rs. 3 lakhs to Rs. 6 lakhs come under LIG group.

3. Medium Income Group (MIG1): Person whose income between Rs 6 lakhs to Rs 18 lakhs will fall under the MIG1 category. These people can avail loans of up to Rs.9 lakh for the construction of a residence.

4. Medium Income Group (MIG2): Persons whose income between Rs 12 to Rs 18 lakhs will fall under the MIG2 category. These people can get loans of up to Rs. 12 lakhs.

5. Minorities: Peoples from minority group like SC/ST/OBC will fall under minorities. To avail PMAY scheme they need to provide relevant caste and income certificates.

6. Women: Women’s from EWS/LIG categories will be considered if they apply for PMAY scheme.

a. ISSR: GoI grant Rs. 1 lakh per house and State & ULB share will be at the discretion of State at the time of formulation of project

b. AHP & BLC: Central assistance of Rs.1.5 lakh per dwelling unit andState & ULB share will be at the discretion of State at the time of formulation of project

c. CLSS: Upfront subsidy @ 6.5% for EWS and LIG for loans upto Rs. 6 lakh. Interest subsidy @4% on home loans upto Rs. 9 lakh for MIG-1 and interest subsidy @3% on home loans upto Rs. 12 lakh for MIG-II.

Subsidy calculator at http://nhb.org.in/government-scheme/pradhanmantri-awas-yojana-credit-linked-subsidy-scheme/

MoU with NHB or HUDCO. Check for MoU at

http://www.mhupa.gov.in/User_Panel/UserView.aspx?TypeID=1499.

Helpline Numbers for CLSS: NHB: 1800-11-3377, 1800-11-3388,

HUDCO:1800-11-6163

Yes, you may apply for the PMAY subsidy if you are single, however there are different criteria. Unmarried men can make use of the PMAY subsidy if their mother is the co-applicant. In some cases they may apply when there is no surviving woman in the family. Unmarried women unfortunately cannot apply for the PMAY subsidy.

In order to get PMAY subsidy you must successfully qualify for a home loan.

The entire subsidy will be given upfront to the housing finance company. This will result in a reduction in the housing loan amount and consequently the EMI will also reduce.

If the roof of your village house is not made of concrete, it is not considered a ‘pucca’ house, but you will still qualify for the housing subsidy.

STEP 1: First you book a flat and apply for a housing loan

STEP 2: Bank sanctions your loan

STEP 3: Registration of the agreement

STEP 5: Your housing finance company / bank submits the claim of the subsidy to National Housing Bank

STEP 6: National Housing Bank transfers the amount to your bank

STEP 7: Bank deposits the subsidy to your loan account

STEP 8: Loan reduces to the extent of the subsidy received and the reduced EMI is set

The bank will receive the subsidy within 3 months of the application.

Yes, both widows and divorcees can apply.

There is no age limit, as long as however you should be eligible for a Home Loan.

PMAY scheme comprises of four key aspects. One, it aims to transform slum areas by building homes for slum dwellers in collaboration with private developers. Two, it plans to give a credit-linked subsidy to weaker and mid income sections on loans taken for new construction or renovation of existing homes.

An interest subsidy of 3 per cent to 6.5 per cent has been announced for loans ranging between ₹6 lakh and ₹12 lakh. For those in the EWS and LIG category who wish to take a loan of up to ₹6 lakh, there is an interest subsidy (concession) of 6.5 per cent for tenure of 15 years. So far around 20,000 people have availed of loans under this scheme. This month, the Government increased the loan amount to ₹12 lakh, targeting the mid-income category. The interest subsidy on loans upto ₹12 lakh will be 3 per cent. In rural areas, interest subvention of 3 per cent is offered on loans up to ₹2 lakh for constructing new homes or extension of old homes.

Three, the Government will chip in with financial assistance for affordable housing projects done in partnership with States/ Union Territories for the EWS. Four, it will extend direct financial assistance of ₹1.5 lakh to EWS.

Launched in 2015, it aims to build 20 million houses by March 2022. The Government envisages to build pucca houses with facilities like sanitation, water, electricity supply etc. It covers people in EWS with an annual income of less than Rs. 3 lakhs, LIG with an annual household income of Rs. 3-6 lakhs, middle income group (MIG I) with income of less than Rs. 12 lakhs and MIG II with income between Rs. 12-18 lakhs.