Published on Mar 04, 2023

KSFE Chitty Schemes 2020 : The Kerala State Financial Enterprises Limited, popularly known as KSFE,

• Is a Miscellaneous Non-Banking Finance Company,

• Is fully owned by the Government of Kerala.

• Is one of the most profit-making public sector undertaking of the State.

A wide range of Deposit Schemes are offered by KSFE. List of deposit schemes available are,

One of the best deposit schemes offered by KSFE. Sugama Deposit Scheme, in its mode of action/procedure, is comparable to the Savings Bank deposits in banks, but with a higher interest rate. Sugama Scheme is the best in the savings account category as it is offering an interest rate of 6.5%, while the maximum interest offered by banks for this scheme is 3.5%. Sugama acts as a safe and sound transaction scheme for automated chitty installments payment, deposit interest withdrawals and day-to-day dealings.

KSFE is collecting Short Term Deposits for periods ranging from 30 days to 364 days offering attractive rates of interest for different slabs. Individuals and Institutions can prefer this deposit for temporary parking of fund. When compared to Nationalised and Scheduled Banks, the rates of interest are much higher. Minimum amount that can be deposited under this scheme is Rs.5,000/-

Deposits in multiples of Rs.500/- will be accepted.

Short Term Deposits will be accepted as security to future liability in chitty and loan schemes of KSFE. On maturity these deposits can be renewed for a further period at the then existing rates. Provision is also there for premature closure of these deposits.

This scheme is specifically designed for the chitty subscribers, which allows the prized subscriber to deposit the prize money in full/part against future liability intending to withdraw the same on furnishing adequate alternate security or repayable on termination of the chitty, provided that the amount deposited under this scheme should not exceed the future liability in the chitty. The period of deposit is minimum 30 days from the opening of chitty and maximum till the date of termination of chitty.

KSFE lets you make fixed deposits with higher interest rates. Fixed deposit scheme offered by KSFE has many features similar to that of Fixed Deposits (FD) in banks. But the return offered by KSFE is comparatively higher than that of banks. The interest rate of deposits from the public is 7% per annum, chitty prize money deposit is 7.5% and for fresh deposits from senior citizens is 8.25%. The effective returns are higher than the published interest rates, because of monthly payment of interest.

The Sugama Security Scheme is intended for accepting amount outstanding in Sugama Deposits as security towards future liability in chitty and other schemes. The advantage under this scheme is that the advance will be secured and the monthly instalments can be adjusted from the account and at the same time the customers can enjoy interest income on the Sugama Deposit.

Sugama Security Account is to be opened in the name of the subscriber/loanee only either by depositing the future liability in cash or by transfer. No further remittance by any mode is allowed in this account. The deposit amount should atleast be the future liability. However, in the case of combined security the deposit amount can be limited to the shortage of security of chitty/loan amount.

Rate of interest will be the same as for Sugama Account. (Now 5.5%). The depositor can withdraw the interest accrued and credited to the account from time to time. He can withdraw the balance in the account after termination of the liability or on providing alternate security.

For further assistance please contact 9446006213 / 9446006217

1. Click on the link https://ksfeonline.com/home

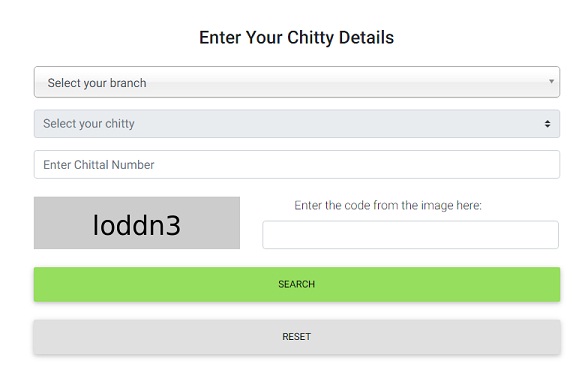

2. Next you have to Enter Your Chitty Details like Branch, Chitty and Chittal Number.

3. Then enter the Captcha Code in the right box.

4. Then click on Search.

5. In the next page you Chitty details will be shown.

6. There will be due amount in the 4th column and click on Pay.

7. Now you can pay using Debit Card / Online Banking / UPI.

8. Once the payment is completed, the e-receipt can be downloaded and stored by entering the name, date of birth and mobile number.

The amount remitted online will be credited to the chitty concerned by the next working day. (An SMS will be sent to the registered mobile.) Customers wishing to be included/participate in chitty auctions should intimate the same to the branch concerned. The amount displayed is the amount till the due date only. If remittance is made after the due date, the amount may vary. Any amount credited to/debited from the chitty directly in the branch after the data processed date is not reflected in the due amount shown.