Published on Mar 04, 2023

Vrudh Sahay Yojana Update Ojas Gujarat : Government of India in the Budget Speech of 2018-19 has announced the enhancement of maximum limit under Pradhan Mantri Vaya Vandana Yojana to Rs. 15 lakhs per senior citizen. The period of sale for this scheme has also been extended upto 31st March, 2020.

LIC of India has been given the sole privilege to operate this scheme. This scheme can be purchased offline as well as online. To Purchase this scheme online please log on to our website www.licindia.in.

1. 60 years or more

2. Member of family in 0 to 20 score of BPL list

respective mamlatdar office, jansevaKendra of respective district collector offices

1. Age Certificate

2. BPL Certificate

Rs.750/- for 60 to 79 age group and Rs. 1000/- for more than 80 yearswhich also includes Rs. 500/- by State Government

Bymoneyorder. Option to get finanicial assistance through Post Account or Bank Acccount pension by D.B.T. credit.

On survival of the Pensioner during the policy term of 10 years, pension in arrears (at the end of each period as per mode chosen) shall be payable.

On death of the Pensioner during the policy term of 10 years, the Purchase Price shall be refunded to the beneficiary.

On survival of the pensioner to the end of the policy term of 10 years, Purchase price along with final pension installment shall be payable.

a) Minimum Entry Age: 60 years (completed)

b) Maximum Entry Age: No limit

c) Policy Term : 10 years

Ceiling of maximum pension is per senior citizen i.e. total amount of pension under all the policies under this plan, including policies taken under Pradhan Mantri Vaya Vandana Yojana with UIN: 512G311V01, allowed to a senior citizen shall not exceed the maximum pension limit.

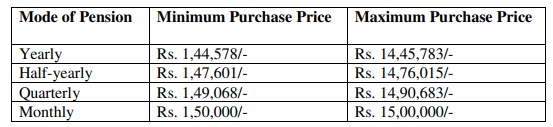

The scheme can be purchased by payment of a lump sum Purchase Price. The pensioner has an option to choose either the amount of pension or the Purchase Price. The minimum and maximum Purchase Price under different modes of pension will be as under:

The Purchase Price to be charged shall be rounded to nearest rupee.

The modes of pension payment are monthly, quarterly, half-yearly & yearly. The pension payment shall be through NEFT or Aadhaar Enabled Payment System. The first instalment of pension shall be paid after 1 year, 6 months, 3 months or 1 month from the date of purchase of the same depending on the mode of pension payment i.e. yearly, half-yearly, quarterly or monthly respectively.

The pension rates for Rs.1000/- Purchase Price for different modes of pension payments are as below:

The pension instalment shall be rounded off to the nearest rupee. These rates are age independent.

The scheme allows premature exit during the policy term under exceptional circumstances like the Pensioner requiring money for the treatment of any critical/terminal illness of self or spouse. The Surrender Value payable in such cases shall be 98% of Purchase Price.

Loan facility is available after completion of 3 policy years. The maximum loan that can be granted shall be 75% of the Purchase Price. The rate of interest to be charged for loan amount shall be determined at periodic intervals. For the loan sanctioned till 30th April, 2018, the applicable interest rate is 10% p.a. payable half-yearly for the entire term of the loan. Loan interest will be recovered from pension amount payable under the policy. The Loan interest will accrue as per the frequency of pension payment under the policy and it will be due on the due date of pension. However, the loan outstanding shall be recovered from the claim proceeds at the time of exit.