Published on Apr 02, 2024

Carbon credits are a key component of national and international attempts to mitigate the growth in concentrations of Greenhouse Gases (GHGs). Carbon trading is an application of an emissions trading (Emissions trading is an administrative approach used to control pollution by providing economic incentives for achieving reductions in the emissions of pollutants approach) & Greenhouse gas emissions are capped and then markets are used to allocate the emissions among the group of regulated sources. The idea is to allow market mechanisms to drive industrial and commercial processes in the direction of low-emissions or less "carbon intensive" approaches than are used when there is no cost to emitting CO2 and other GHGs into the atmosphere.

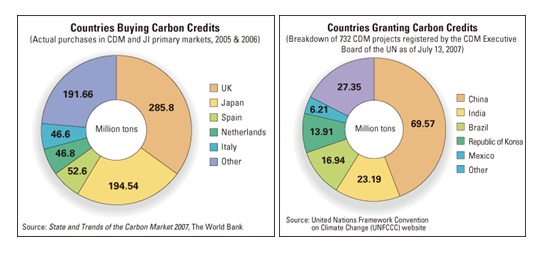

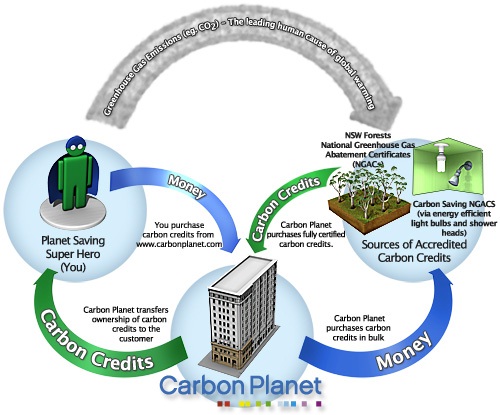

Since GHG mitigations projects generate credits, this approach can be used to finance carbon reduction schemes between trading partners and around the world. There are also many companies that sell carbon credits to commercial and individual customers who are interested in lowering their carbon footprint on a voluntary basis. These carbon offsetters purchase the credits from an investment fund or a carbon development company that has aggregated the credits from individual projects. The quality of the credits is based in part on the validation process and sophistication of the fund or development company that acted as the sponsor to the carbon project. This is reflected in their price; voluntary units typically have less value than the units sold through the rigorously-validated Clean Development Mechanism.

Clean Development Mechanism (CDM) is an arrangement under the Kyoto Protocol allowing industrialized countries with a greenhouse gas reduction commitment (called Annex B countries) to invest in projects that reduce emissions in developing countries as an alternative to more expensive emission reductions in their own countries. A crucial feature of an approved CDM carbon project is that it has established that the planned reductions would not occur without the additional incentive provided by emission reductions credits, a concept known as "additionality". The CDM allows net global greenhouse gas emissions to be reduced at a much lower global cost by financing emissions reduction projects in developing countries where costs are lower than in industrialized countries. However, in recent years, criticism against the mechanism has increased

The Protocol agreed 'caps' or quotas on the maximum amount of Greenhouse gases for developed and developing countries, listed in its Annex I. In turn these countries set quotas on the emissions of installations run by local business and other organizations, generically termed 'operators'. Countries manage this through their own national 'registries', which are required to be validated and monitored. Each operator has an allowance of credits, where each unit gives the owner the right to emit one metric tonne of carbon dioxide or other equivalent greenhouse gas. Operators that have not used up their quotas can sell their unused allowances as carbon credits, while businesses that are about to exceed their quotas can buy the extra allowances as credits, privately or on the open market. As demand for energy grows over time, the total emissions must still stay within the cap, but it allows industry some flexibility and predictability in its planning to accommodate this.

By permitting allowances to be bought and sold, an operator can seek out the most cost-effective way of reducing its emissions, either by investing in 'cleaner' machinery and practices or by purchasing emissions from another operator who already has excess 'capacity'.

Since 2005, the Kyoto mechanism has been adopted for CO2 trading by all the countries within the European Union under its European Trading Scheme (EU ETS) with the European Commission as its validating authority. From 2008, EU participants must link with the other developed countries that ratified Annex I of the protocol, and trade the six most significant anthropogenic greenhouse gases. In the United States, which has not ratified Kyoto, and Australia, whose ratification came into force in March 2008, similar schemes are being considered.

The Kyoto Protocol to the United Nations Framework Convention on Climate Change (UNFCCC) was adopted by more than 150 countries at the third session of the Conference of the Parties to the UNFCCC in Kyoto, Japan, on 11 December 1997. It is an international treaty containing binding constraints on greenhouse gas emissions and, mechanisms aimed at cutting the cost of reducing emissions and establish global markets for greenhouse gas (GHG) emission permits. Under the Kyoto Protocol, industrialized countries and countries with economies in transition will reduce their combined GHG emissions by at least five per cent below their 1990 levels by the first commitment 2008 to 2012. The most important GHG is carbon dioxide (CO2) whose emissions are mainly related to combustion of fossil fuels.

The developed countries commit themselves to reducing their collective emissions of six key greenhouse gases by at least 5%. This group target will be achieved through cuts of 8% by Switzerland, most Central and East European states, and the European Union (the EU will meet its target by distributing different rates among its member states); 7% by the US; and 6% by Canada, Hungary, Japan, and Poland. Russia, New Zealand, and Ukraine are to stabilize their emissions, while Norway may increase emissions by up to 1%, Australia by up to 8%, and Iceland 10%. The six gases are to be combined in a "basket", with reductions in individual gases translated into "CO2 equivalents" that are then added up to produce a single figure.

Each country’s emissions target must be achieved by the period 2008-2012. It will be calculated as an average over the five years. "Demonstrable progress" towards meeting the target must be made by 2005. Cuts in the three most important gases – carbon dioxide (CO2), methane (CH4), and nitrous oxide (N20) - will be measured against a base year of 1990 (with exceptions for some countries with economies in transition).

Cuts in three long-lived industrial gases – hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulphur hexafluoride (SF6) - can be measured against either a 1990 or 1995 baseline. (A major group of industrial gases, chlorofluorocarbons, or CFCs, are dealt with under the 1987 Montreal Protocol on Substances that Deplete the Ozone Layer.)

Actual emission reductions will be much larger than 5%. Compared with emissions levels projected for the year 2000, the richest industrialized countries (OECD members) will need to reduce their collective output by about 10%. This is because many of these countries will not succeed in meeting their earlier non-binding aim of returning emissions to 1990 levels by the year 2000; their emissions have in fact risen since 1990. While the countries with economies in transition have experienced falling emissions since 1990, this trend is now reversing.

Therefore, for the developed countries as a whole, the 5% Protocol target represents an actual cut of around 20% when compared with the emissions levels that are projected for 2010 if no emissions-control measures are adopted.

Countries have a certain degree of flexibility in how they make and measure their emissions reductions. In particular, an international "emissions trading" regime is established allowing industrialized countries to buy and sell emissions credits amongst themselves. They will also be able to acquire "emission reduction units" by financing certain kinds of projects in other developed countries through a mechanism known as Joint Implementation. In addition, a "Clean Development Mechanism" for promoting sustainable development enables industrialized countries to finance emissions-reduction projects in developing countries and receive credit for doing so.

The Protocol shall enter into force on the ninetieth day after the date on which not less than 55 Parties to the Convention, incorporating Annex I Parties which accounted in total for at least 55 % of the total carbon dioxide emissions for 1990 from that group, have deposited their instruments of ratification, acceptance, approval or accession.

1. Joint Implementation (JI, Article 6 Kyoto Protocol) projects in other Annex B countries that lead to Emission Reduction Units (ERUs),

2. Projects in countries without emission targets Clean Development Mechanism (CDM), Article 12 Kyoto Protocol) that lead to Certified Emission reductions (CERs), and

3. International Emission Trading (IET, Article 17 Kyoto Protocol) of Assigned Amount Units (AAUs) among Annex B countries.

The concepts of JI and CDM refer to project based co-operations between two countries, where GHG emission reductions take place in the country with lower marginal abatement costs. In other words, a country that has adopted a quantified GHG emission reduction or limitation commitment under the Kyoto Protocol can fulfils parts of this commitment on the territory of another country where the costs are lower. The CDM envisages a project co-operation between industrialized countries with commitments (Annex I countries) and developing countries (non-Annex I countries), which have exempted from quantified commitments under the Protocol (JI refers to a project-based co-operation between two industrialized countries).

The main benefits that can be expected from the project-based Kyoto mechanisms are, on the one hand, that they potentially reduce industrialized countries’ costs of meeting the Kyoto Protocol targets, whereas, on the other hand, they are to support the host countries objectives regarding sustainable development.

With the help of CDM, countries which have set themselves an emission reduction target under the Kyoto Protocol (Annex I countries) can contribute to the financing of projects in developing countries (non-Annex I countries) which do not have a reduction target. Contributing to the sustainable development of the host country, the project should reduce the emission of greenhouse gases. The achieved emission reductions can be used by the Annex I country in order to meet its reduction target.

The return of CDM investments depends on how emission permits are used by the investor.

There are two basic options for the investor:

1. Sell the emission permits to other companies or governments on international markets

2. Use the emission credits for offsetting emissions of own operations outside the CDM host country that are regulated by climate policies.

A third option might be banking or saving of emission permits for future use.

Depending on the specific circumstances, renewable energy projects may generate emission permits, thus increasing the expected return. Market prices for emission permits are estimated to be between 5 to 20 EUR per ton CO2 [Janssen (2001)]. Overall financial risk of renewable energy projects may be reduced by engaging in emissions trading and the Kyoto Mechanisms.

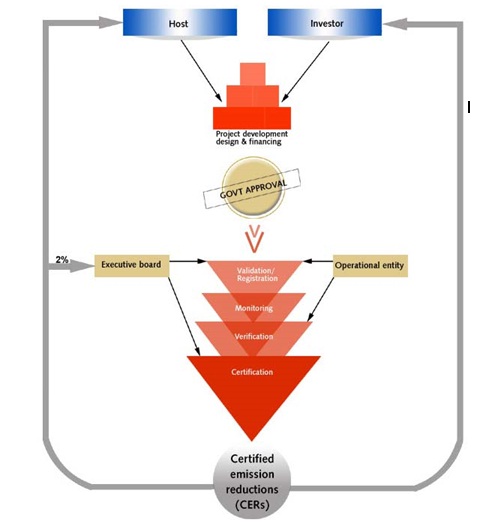

Along the CDM project cycle may arise a variety of different transaction costs. This includes the following:

Project identification and selection: Search costs incurred by project developers and potential investors in identifying prospective projects. The costs for developing project selection criteria, costs of ranking projects according to the preferences of investors are also encompassed

Project development and baseline determination: Information costs related to the preparation of a project concept note providing relevant information on project baseline, expected additional emission reductions and corresponding costs.

Project validation: Validation is the process of independent evaluation of a project activity on the basis of the project design document.

Project approval: Projects need to be approved by the host government.

Project registration: Registration is the formal acceptance by the relevant international bodies of a validated project as a CDM project activity.

Project implementation: Monitoring and enforcement costs of contracts during construction, start-up and operation phase.

Project monitoring and reporting: Monitoring refers to the measurement of data for the determination of actual GHG emissions. Reporting relates to reporting the measured relevant data and the subsequently calculated actual GHG emissions of a project.

Project certification: Certification is the written assurance by a designated operational entity that, during a specific time period, a project activity achieved the emission reductions as verified.

Transfer and use of emission permits: Transactions costs at that stage include reporting of transfers of emission permits to dedicated registries.

A credit can be an emissions allowance which was originally allocated or auctioned by the national administrators of a cap-and-trade program, or it can be an offset of emissions. Such offsetting and mitigating activities can occur in any developing country which has ratified the Kyoto Protocol, and has a national agreement in place to validate its carbon project through one of the UNFCCC's approved mechanisms. Once approved, these units are termed Certified Emission Reductions, or CERs. The Protocol allows these projects to be constructed and credited in advance of the Kyoto trading period.

The Kyoto Protocol provides for three mechanisms that enable countries or operators in developed countries to acquire greenhouse gas reduction credits.

1. Under Joint Implementation (JI) a developed country with relatively high costs of domestic greenhouse reduction would set up a project in another developed country.

2. Under the Clean Development Mechanism (CDM) a developed country can 'sponsor' a greenhouse gas reduction project in a developing country where the cost of greenhouse gas reduction project activities is usually much lower, but the atmospheric effect is globally equivalent. The developed country would be given credits for meeting its emission reduction targets, while the developing country would receive the capital investment and clean technology or beneficial change in land use.

3. Under International Emissions Trading (IET) countries can trade in the international carbon credit market to cover their shortfall in allowances. Countries with surplus credits can sell them to countries with capped emission commitments under the Kyoto Protocol.

These carbon projects can be created by a national government or by an operator within the country. In reality, most of the transactions are not performed by national governments directly, but by operators who have been set quotas by their country.

For trading purposes, one allowance or CER is considered equivalent to one metric tonne of CO2 emissions. These allowances can be sold privately or in the international market at the prevailing market price. These trade and settle internationally and hence allow allowances to be transferred between countries. Each international transfer is validated by the UNFCCC. The European Commission additionally validates each transfer of ownership within the European Union.

Climate exchanges have been established to provide a spot market in allowances, as well as futures and options market to help discover a market price and maintain liquidity. Carbon prices are normally quoted in Euros per tonne of carbon dioxide or its equivalent (CO2 e). Other greenhouse gasses can also be traded, but are quoted as standard multiples of carbon dioxide with respect to their global warming potential. These features reduce the quota's financial impact on business, while ensuring that the quotas are met at a national and international level.

Currently there are five exchanges trading in carbon allowances: the Chicago Climate Exchange, European Climate Exchange, Nord Pool, PowerNext and the European Energy Exchange. Recently, NordPool listed a contract to trade offsets generated by a CDM carbon project called Certified Emission Reductions (CERs). Many companies now engage in emissions abatement, offsetting, and sequestration programs to generate credits that can be sold on one of the exchanges. At least two private electronic markets have been established in 2008:

The first commitment period of the Kyoto Protocol excluded forest conservation/avoided deforestation from the CDM for a variety of political, practical and ethical reasons. However, carbon emissions from deforestation represent 18-25% of all emissions, and will account for more carbon emissions in the next five years than all emissions from all aircraft since the Wright Brothers until at least 2025. Forests First in the Fight against Climate Change] Global Canopy Programme, 2007. This means that there have been growing calls for the inclusion of forests in CDM schemes for the second commitment period from a variety of sectors, under the leadership of the Coalition for Rainforest Nations, and brought together under the Forests Now Declaration, which has been signed by over 300 NGOs, business leaders, and policy makers. There is so far no international agreement about whether projects avoiding deforestation or conserving forests should be initiated through separate policies and measures or stimulated through the carbon market. One major concern is the enormous monitoring effort needed in order to make sure projects are indeed leading to increased carbon storage. There is also local opposition. For example, May 2nd 2008, at the United Nations Permanent Forum on Indigenous Issues (UNPFII), Indigenous leaders from around the world protested against the Clean Energy Mechanisms, especially against Reduced Emissions from deforestation and degradation.

(1) Provide an additional source of revenue

(2) Improve the return on investments in Projects

(3) Boost the economic feasibility of projects

(4) Accelerate project implementation

(5) Contribution towards the fight against Global warming.

It is also important for any carbon credit (offset) to prove a concept called additionality. Additionality is a term used by Kyoto's Clean Development Mechanism to describe the fact that a carbon dioxide reduction project (carbon project) would not have occurred had it not been for concern for the mitigation of climate change. More succinctly, a project that has proven additionality is a beyond-business-as-usual project.

It is generally agreed that voluntary carbon offset projects must also prove additionality in order to ensure the legitimacy of the environmental stewardship claims resulting from the retirement of the carbon credit (offset). According the World Resources Institute/World Business Council for Sustainable Development (WRI/WBCSD): "GHG emission trading programs operate by capping the emissions of a fixed number of individual facilities or sources. Under these programs, tradable 'offset credits' are issued for project-based GHG reductions that occur at sources not covered by the program. Each offset credit allows facilities whose emissions are capped to emit more, in direct proportion to the GHG reductions represented by the credit. The idea is to achieve a zero net increase in GHG emissions, because each tonne of increased emissions is 'offset' by project-based GHG reductions. The difficulty is that many projects that reduce GHG emissions (relative to historical levels) would happen regardless of the existence of a GHG program and without any concern for climate change mitigation. If a project 'would have happened anyway,' then issuing offset credits for its GHG reductions will actually allow a positive net increase in GHG emissions, undermining the emissions target of the GHG program. Additionality is thus critical to the success and integrity of GHG programs that recognize project-based GHG reductions."

Carbon credits have become entrenched in the broader climate change debate; however, fundamental scientific and methodological problems persist. While these remain unresolved, they have the potential to seriously undermine the financial and environmental value of any carbon credits scheme. The danger is that reducing emissions at source and re-capturing carbon through sequestration are being treated by government and industry as equivalent policy options. ET should not be a mechanism that facilitates the transfer of fossilized carbon locked away for millions of years over to short-term biotic sinks. For this reason, the issue of carbon sinks is currently undermining the integrity of carbon credits and the creation of a carbon trading market.

Carbon credits are now a key component of national and international emissions trading schemes. They provide a way to reduce greenhouse effect emissions on an industrial scale by capping total annual emissions and letting the market assign a monetary value to any shortfall through trading. Credits can be exchanged between businesses or bought and sold in international markets at the prevailing market price. Credits can be used to finance carbon reduction schemes between trading partners and around the world.

There are also many companies that sell carbon credits to commercial and individual customers who are interested in lowering their carbon footprint on a voluntary basis. These carbon off-setters purchase the credits from an investment fund or a carbon development company that has aggregated the credits from individual projects. The quality of the credits is based in part on the validation process and sophistication of the fund or development company that acted as the sponsor to the carbon project.

Carbon credits create a market for reducing greenhouse emissions by giving a monetary value to the cost of polluting the air. Emissions become an internal cost of doing business and are visible on the balance sheet alongside raw materials and other liabilities or assets. The ultimate objective of regulating pollution through MBIs is improved environmental quality.

1. Climate change and KYOTO Protocol’s, clean development mechanism by M. Orford, S.Raubenheimer, Barry Kantor.

2. Green wealth by Kevin Francis Noon.

3. Emissions trading principles and practice by Thomas H Tietenberg.

4. From Wikipedia, the free encyclopedia.

5. http//www.preserval.com

| Are you interested in this topic.Then visit the below page to get the full report |