Published on Oct 08, 2021

Pension Seva Kerala : State Bank of India (SBI) has a website for pensioners (other than staff pensioners) having pension accounts. This website is quite easy to use and it benefits common pensioners. Around 54 lakh pensioners across the country are taking advantage of SBI service.

Pensioners can login on the SBI Pension Seva (SBI Pension Services) website and check their pension details. The dedicated website for the pensioners, ‘SBI Pension Seva’ is very easy to use and will definitely benefit the general public pensioners.

It is important to mention that State Bank of India is the largest pension paying bank in the country, serving around 54 lakhs pensioners all over India. And in order to provide the best of services to its customers especially the senior citizens, the lender has collaborated with Central Government agencies (Railways, Defence, Civil, Postal, Telecom) State Government departments & different autonomous bodies for pension processing.

In addition, the bank also offers various types of loans for the general public and farmers including SBI gold loans for different agriculture purpose.

The SBI pensioners will get these benefits;

• SMS alert on their mobile phone with all pension payment details.

• Pension slip via email or pension paying branch.

• Facility to submit life certificate at any branch of SBI.

• Jeevan Pramaan facility available at the branches.

• Senior Citizen Savings Scheme or SCSS

• EPPO provision for Railway/Defence/CPAO/Rajasthan pensioners

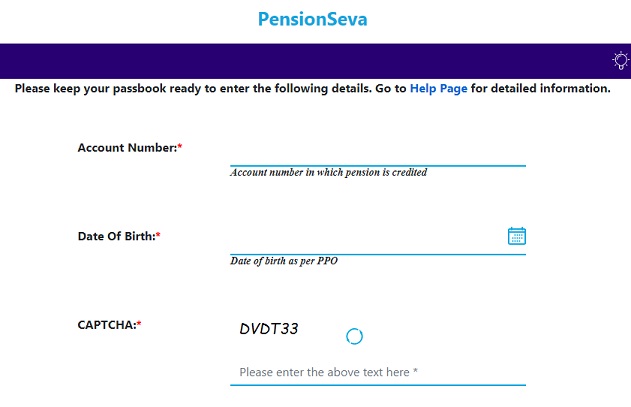

• Firstly visit the website https://www.pensionseva.sbi/

• Enter your account number in which pension is credited

• Enter your Date of Birth (in the format - dd/mm/yyyy).

• An OTP would be sent to the registered Email ID/Mobile Number. Enter the OTP and proceed.

• Create a User ID. Minimum 5 alphanumeric characters including upper and lowercase. Maximum length 7 characters. 0-9, A-Z, a-z

• Enter new password, then confirm password

• Choose a security question and answer and save for future reference, as it will be required in case you forget your password.

• Password and security answer are case-sensitive.

• After successful registration, pensioner can login through the registered ID/Password.

• User account will be locked out automatically after three consecutive unsuccessful login attempts.

• Pension profile details

• Download Pension / Form 16

• Download arrear calculation sheets

• Transaction details

• Investment related details

• Status of life certificate

• In case of any issue while login, please send mail to support.pensionseva@sbi.co.in along with error screen shot.

• SMS “UNHAPPY” can be sent on 8008202020

• SBI Customer Care 24*7. Toll Free Numbers - 18004253800/1800112211 OR 080-26599990

• Complaint can also be lodged at bank’s website https://bank.sbi and emails can be sent to customercare@sbi.co.in / dgm.customer@sbi.co.in / gm.customer@sbi.co.in

Ans: Yes, a pensioner can draw his/her pension from a SBI Branch if he/she is a Central/State Govt. Pensioner or Autonomous Body, which has arrangement for pension payment with our Bank.

Ans: Yes. Even the Government employees earlier drawing their pension from a Treasury or from a Post Office will have the option to draw their pension from the authorized Bank’s Branches.

Ans: Yes. All Central Government Pensioners and those State Governments which have accepted such arrangement can open Joint Account with their spouses.

Ans: The disbursement of pension by paying branch is spread over the last four working days of the month depending on the convenience of the pension paying Branch except for the month of March when the pension is credited on or after the first working day of April

Ans: The pensioner can submit life certificate at any branch of the Bank either in person or through his/her authorized representative. The receiving official will acknowledge receipt of the Life Certificate.