Published on Mar 11, 2019

Pradhan Mantri Shram Yogi Mandhan (PMSYM) is a 2019 scheme introduced by Government of India for poor laborers in the unorganised sector from minimum 18years of age to maximum 40 years. Under the scheme, a monthly pension of ₹3,000 (US$42) per month is provided to workers in the unorganised sector over 60 years of age. However, to benefit from the scheme, workers have to contribute ₹55 monthly (for age 18) and it varies according to age. Maximum contribution for a year cannot exceed ₹2400 (Rs.200 per month).

Informal workers can now subscribe to the Pradhan Mantri Shram Yogi Maan-Dhan (PMSYM) scheme, which provides an assured monthly pension of Rs 3,000, at 3.13 lakh common service centres (CSCs) across the country. “CSC e-Governance Services India Ltd, a special purpose vehicle (SPV) under the Ministry of Electronics and IT, has begun the registration process for the PMSYM scheme, covering unorganised sector workers of age between 18 and 40 years, making them eligible for a minimum monthly pension of Rs 3,000 after the age of 60 in lieu of contributions made under the scheme,” an official said.

Being implemented by the labour ministry, the ambitious social security scheme was announced by Finance Minister Piyush Goyal in the Interim Budget 2019-20 and is targeted at unorganised sector workers with monthly income of up to Rs 15,000. The target is to cover 10 crore informal sector workers in five years. The government has roped in CSC e-Governance Services India Ltd for mobilising and registering beneficiaries across India. The SPV has a network of over 3.13 lakh CSCs across India. “Of these 3.13 lakh CSCs, over 2.13 lakh are operating at the gram panchayat level. With such a reach, CSC is the perfect partner for us to ensure that the scheme covers all needy people, particularly those living in rural and semi-urban areas,” the official said. The enrolment will be carried out by all the CSCs.

(1) This Scheme shall be open only to the unorganised worker for joining, whose monthly income is not exceeding fifteen thousand rupees and who has a savings bank account in his name and Aadhar number.

(2) The unorganised worker referred to in sub-paragraph shall be not less than eighteen years of age and not exceeding forty years of age.

(3) The unorganised worker referred to in sub-paragraph (1) shall not be eligible to join the Scheme, if he is covered under National Pension Scheme contributed by the Central Government or Employees’ State Insurance Corporation Scheme under the Employees’ State Insurance Act, 1948 (34 of 1948) or Employees’ Provident Fund Scheme under the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952 (19 of 1952) or he is an income-tax assessee.

The unorganised workers may visit their nearest CSC along with their Aadhaar cards and savings bank account or Jan Dhan account passbooks and get registered themselves for the scheme. Contribution amount for the first month shall be paid in cash for which they will be provided with a receipt. CSC e-Governance Services India Ltd has prepared an application form for PMSYM and is also hosting it to ensure that the entire registration process and data collection takes place in a smooth manner. It will also issue cards having unique ID number to all those who registers under the scheme. CSC e-Governance Services India Ltd is the exclusive partner of the labour ministry in implementing the scheme. CSCs, which also work as banking correspondents for several banks in remote and rural locations, will also help those willing to enrol under PMSYM to open bank accounts at the CSC without going to bank branches. “At a later stage, the ministry is also looking at enrolling people through PMSYM’s web portal or can download the mobile app and self-register using Aadhaar number/savings bank account/ Jan Dhan account number on self-certification basis,” the official said.

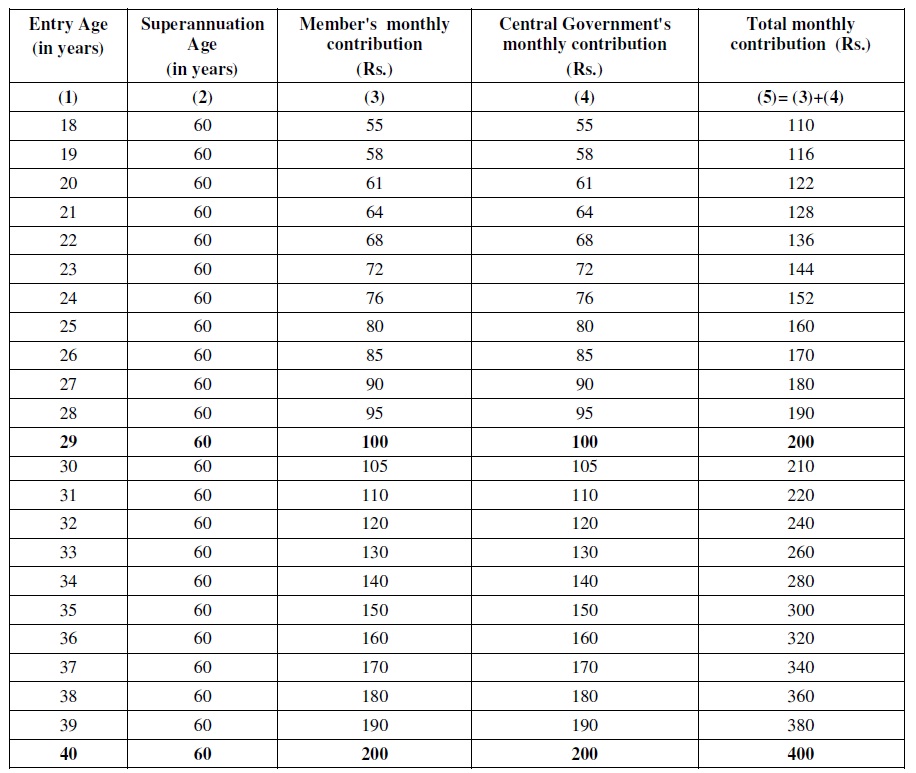

The monthly contribution by the worker joining the scheme at 18 years of age would be Rs 55, with matching contributions from the government. The contributions would rise at higher age. The worker joining the scheme at the age of 40 years would contribute Rs 200, while workers at the age of 29 years would pay Rs 100. The scheme would cover unorganised workers who are working or engaged as home-based workers, street vendors, mid-day meal workers, head loaders, brick kiln workers, cobblers, rag pickers, domestic workers, washer men, rickshaw pullers, landless labourers, agricultural workers and construction workers, among others. However, the informal workers will not be eligible for the scheme if they are covered under the National Pension Scheme, the Employees’ State Insurance Corporation Scheme or the Employees’ Provident Fund Scheme.

• Under this(Pradhan Mantri Shram Yogi Mandhan) mega pension yojana of the Prime Minister, financial assistance of Rs. 3 thousand will be provided as pension to every citizen working in all unorganized sector of the country.

• Apart from this, the benefit of this government pension Shram Yogi Mandhan yojana can only be taken by those citizens whose monthly income is 15 thousand or less.

• If the eligible candidate wants to take advantage of this Shram Yogi Mandhan pension scheme, they will have to deposit Rs.100 in their bank account every month.

• The benefits of Shram Yogi Mandhan Pension Scheme will be given to the citizens working in 10 crores unorganized sector of the country.

• The pension will be started only after getting the age of 60 years.

(1) Each eligible subscriber under this Scheme shall receive assured minimum monthly pension of three thousand rupees after attaining the age of sixty years.

(2) Once the eligible subscriber joins this Scheme at the entry age between eighteen to forty years, such subscriber has to contribute till attaining the age of sixty years and on attaining his age of sixty years, such subscriber shall be entitled to get the assured minimum monthly pension of three thousand rupees with benefit of family pension specified in paragraph 9, as the case may be.

The exit provisions and benefits thereunder, of this Scheme are as under, namely:—

(i) in case an eligible subscriber exits this Scheme within a period of less than ten years from the date of joining the Scheme by him, then the share of contribution by him only will be returned to him with savings bank rate of interest payable thereon;

(ii) if an eligible subscriber exits after completion of a period of ten years or more from the date of joining the Scheme by him but before his age of sixty years, then his share of contribution only shall be returned to him along with accumulated interest thereon as actually earned by the Pension Fund referred to in sub-paragraph (1) of paragraph 3 or the interest at the savings bank interest rate thereon, whichever is higher;

(iii) if an eligible subscriber has given regular contributions and died due to any cause, his spouse shall be entitled to continue with the Scheme subsequently by payment of regular contribution as applicable or exit by receiving the share of contribution paid by such subscriber along with accumulated interest, as actually earned thereon by the Pension Fund, referred to in sub-paragraph (1) of paragraph 3 or at the savings bank interest rate thereon, whichever is higher;

(iv) after death of subscriber and his or her spouse, the corpus shall be credited back to the fund;

(v) in case of exit on account of clauses (i), (ii) and (iii) above, the accumulated share of Government’s contribution shall be credited back to the Pension Fund;

(vi) any other exit provision, including nomination, as may be decided by the Central Government by issuing instructions from time to time.

1. Interested eligible person shall visit nearest CSC centre. Location of CSC centre can be ascertained from the information page on web sites of LIC of India, Ministry of Labour and Employment and CSC.

2. While going to CSC for enrolment, he shall carry with him the following :

I. Aadhar Card

II. Savings/Jan Dhan Bank Account details along with IFS Code ( Bank Passbook or Cheque Leave/book or copy of bank statement as evidence of bank account )

III. Initial contribution amount in cash for enrolment under the scheme

3. Village Level Entrepreneur (VLE) present at the CSC will key-in aadhar number, name of subscriber as printed on aadhar card and date of birth as given in aadhar card and the same will be verified with UIDAI database.

4. Further details like Bank Account details, Mobile Number, Email-id, if any, spouse and nominee details will be captured.

5. Self-certification for eligibility conditions will be done.

6. System will auto calculate monthly contribution payable according to age of the subscriber.

7. Subscriber shall also pay the amount of 1st subscription in cash to the VLE who will generate receipt to be handed over to the subscriber.

8. Enrolment Form cum Auto Debit mandate will also be printed which will then be signed by the subscriber. VLE then shall scan the signed enrolment cum auto debit mandate and upload into the system.

9. At the same time, a unique Shram Yogi Pension Account Number will be generated and Shram Yogi Card will be printed at CSC

10. With completion of process, subscriber will be having with him Shram Yogi Card and signed copy of enrolment form for his record.

11. He will also receive regularly SMS on activation of auto debit and Shram Yogi Pension Account details.