Published on Mar 04, 2023

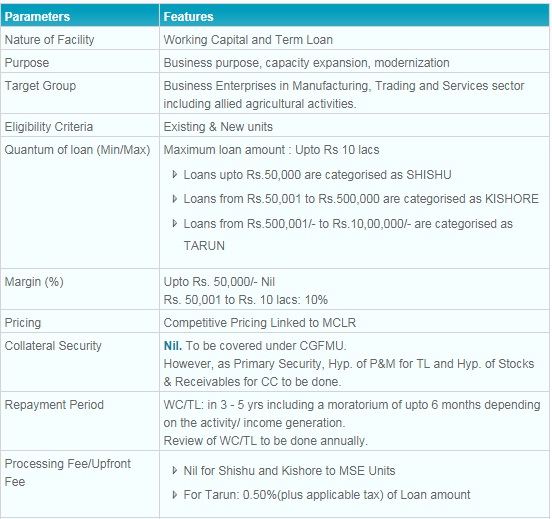

Mudra Loan Yojana - Loan Limits, Interest Rates : Mudra loans are offered by most leading banks in India to aid non-corporate, non-farm sector income generating microenterprises that require credit below Rs.10 lakh. Mudra loan interest rates range from 11.20% to 20%.

It depends upon many thinks like quantum of loan, internal rating and product even.

The different banks may have different rates but upto the amount of Rs 1 lac the GOI has advised the banks to cap the rates to 10% but there are banks (Inclusive of mine) which offer the loan upto 1.00 lac at 9.70% even and as of now.

ROI under MUDRA is as under

Loan upto 2 Lakh : MCLR + 0

Loan above 2lakh and upto 5 lakh : MCLR +1

Loan above 5 and upto 10 lakh : MCLR + 2

Currently MCLR in Punjab and Sind bank is 8.55% P.A.

The borrowers must be from the following Non-corporate Small Business Segment:

1. Proprietorship

2. Partnership firms

3. Small manufacturing units

4. Service sector units

5. Shopkeepers

6. Fruit or vegetable vendors

7. Truck operators

8. Food service units

9. Repair shops

10. Machine operators

11. Small industries

12. Food processors

13. Other industries in rural and urban areas.

In addition to the above, individuals also require various business statements and a report projecting their revenue as part of the eligibility for MUDRA loan.

• Mudra application form

• Vehicle loan application form

• 2 passport size colour photographs

• Photo Identity proof

• Address proof

• Income proof

• Bank statement (last 6 months)

• Mudra application form

• BIL application form

• Photo identity proof

• Address proof

• Establishment proof

• Bank statement (last 6 months)

• Ownership proof of residence/office

• Proof of continuity of business

• Proof of qualification

• Trade references

• 2 years ITR

• CA certified financials

• Mudra application Form

• BIL/RBC application form

• Photo identity and age proof

• Address proof

• Ownership proof of residence/office

• Business vintage proof

• Bank statement (last 12 months)

• Income tax return (last 2 years)

Vehicle loan: Commercial vehicle loan, Car loan and Two-wheeler loan

Business Installment Loan (BIL): Loan for working capital requirement, buying plant and machinery, renovating offices etc.

Business Loans Group Loans (BLG) and Rural Business Credit (RBC): We offer Drop line overdraft/Overdraft facility/Working capital loans

It depends upon many thinks like quantum of loan, internal rating and product even.

The different banks may have different rates but upto the amount of Rs 1 lac the GOI has advised the banks to cap the rates to 10% but there are banks (Inclusive of mine) which offer the loan upto 1.00 lac at 9.70% even and as of now.

The main objectives of Mudra are as follows.

1. Regulating the borrower and lender of microfinance and forging a stability in the sector through inclusive participation.

2. Extending credit and finance to support microfinance institutions (MFIs) and agencies that lend money to self-help groups, small business, traders, and individuals.

3. Registering all MFIs and putting in place an accreditation and performance rating system for the first time. It will help the last-mile borrowers to evaluate and approach MFIs that best meets their requirements and whose records, as a lender, are the most satisfactory. Such a measure will also introduce competitiveness among the institution. The borrower will be the ultimate beneficiary.

4. Providing structured guidelines for borrowers to avoid business failures, or adopt timely corrective measures. Mudra will also help to lay down the acceptable procedures and guidelines to be followed by lenders for recovering money from defaulters.

5. Developing standardised covenants that would become the backbone of the last-mile business in future.

6. Introducing proper technologies to assist swift lending and monitoring of the disbursed money.

7. Building a stable framework under the PMMY to develop an efficient last-mile credit deliver system for small businesses.

MUDRA, which stands for Micro Units Development & Refinance Agency Ltd, is a financial institution beingset up by Government of India for development and refinancing micro units enterprises. It was announced by the Hon’ble Finance Minister while presenting the Union Budget for FY 2016. The purpose of MUDRA is to provide funding to the non-corporate small business sector through various Last Mile Financial Institutions like Banks, NBFCs and MFIs.

MUDRA is a refinancing agency which will extend its funds to Last Mile Financiers to enable them to reach out to the sector. Access to finance in conjunction with rational price is going to be the unique customer value proposition of MUDRA. It will use a variety of innovative financing means including technology to bring down the cost of funding for the ultimate borrower.

Here are some points that ideated the setting up of Mudra.

• PMMY is expected to benefit over 58 million small business owners and entrepreneurs in the country. More than 120 million people are employed in this sector and they mostly come from the underprivileged sections of the society.

• Most of the small business owners have always remained beyond the ambit of organised and mainstream bank credit. This is because products and services of most banks and financial institutions mostly target secured businesses that can afford to pay a higher rate of interest. PMMY attempts to change the trend.

• While institutional finance was always relevant to small businesses, inadequate corpus and unorganised credit management, failed to reach it to eager entrepreneurs. Mudra is backed by a dream to fulfil the aspirations of many young and budding entrepreneurs spread beyond the big metros.

• Repayment has always been a major concern for institutional lenders shying away from extending credit to small entrepreneurs in semi-urban and rural areas. But Mudra promises to assure the lenders on this front and help both banks and MFIs, and small business owners come on a common platform.

Micro Units Development and Refinance Agency Bank has been set up by the Indian Government to fulfil all the funding needs of the non-corporate small business. The responsibility of Micro Units Development and Refinance Agency Bank is to prepare and launch the policy guidelines and registration and regulation of Micro Finance Institution entities. They are also responsible to run a credit guarantee scheme and create a good architecture to serve micro business by offering financial assistance.

Pradhan Mantri Mudra Yojana is a new scheme under Micro Units Development and Refinance Agency for developing and refinancing activities that are relating to micro units. This scheme was announced while presenting the budget for the 2016 financial year. The main purpose of this loan is to provide funds to non-corporate small business sectors.

Critics of the scheme say that too many best practices in loan origination have been neglected while authorising and disbursing loans. Earlier this year, the CBI registered a case against a former official of Punjab National Bank for alleged abuse of official position in sanctioning and disbursing 26 Mudra loans amounting to ₹65 lakh. Even if loans are sought by business owners genuinely seeking growth and bankers disburse them with an eye on economic development, ensuring repayment is still a challenge. First, these loans are unsecured — a collateral that could protect the interests of the bank is not required, unless an asset that is purchased can itself serve as collateral.

The Mudra Loan Interest Rate is meant for those who need small amounts, but do not have access to such funds, but the very nature of the business of such borrowers is susceptible to volatility and annual cycles, not to mention the itinerant ways of some business owners, such as vegetable vendors. They may choose one location for their place of business on a day, and another elsewhere in their city the next day. Further, the public banking system may not be staffed for work this may entail. When it comes to collection, bank staff may choose to go after one loan with outstanding of ₹10 lakh, for example, rather than 10 loans of ₹1,00,000 each.