Published on Oct 24, 2018

1. Atal Pension Yojana (APY) is open to all bank account holders. The Central Government would also co-contribute 50% of the total contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber, for a period of 5 years, i.e., from Financial Year 2015- 16 to 2019-20, who join the APY before 31st December, 2015, and who are not members of any statutory social security scheme and who are not income tax payers. Therefore, APY will be focussed on all citizens in the unorganised sector.

2. Under APY, the monthly pension would be available to the subscriber, and after him to his spouse and after their death, the pension corpus, as accumulated at age 60 of the subscriber, would be returned to the nominee of the subscriber.

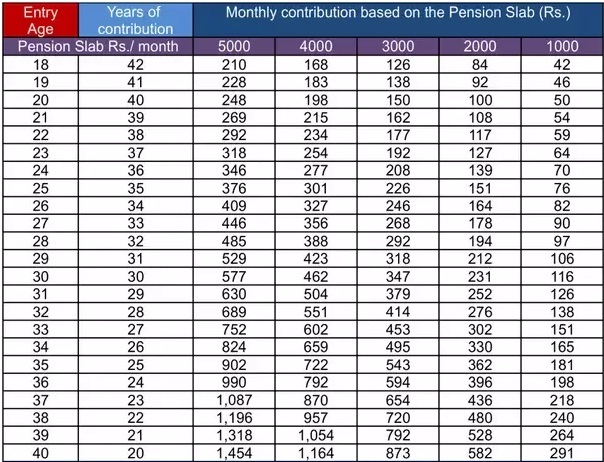

3. Under the APY, the subscribers would receive the fixed minimum pension of Rs. 1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, Rs. 5000 per month, at the age of 60 years, depending on their contributions, which itself would be based on the age of joining the APY. Therefore, the benefit of minimum pension would be guaranteed by the Government. However, if higher investment returns are received on the contributions of subscribers of APY, higher pension would be paid to the subscribers.

4. A subscriber joining the scheme of Rs. 1,000 monthly pension at the age of 18 years would be required to contribute Rs. 42 per month. However, if he joins at age 40, he has to contribute Rs. 291 per month. Similarly, a subscriber joining the scheme of Rs. 5,000 monthly pension at the age of 18 years would be required to contribute Rs. 210 per month. However, if he joins at age 40, he has to contribute Rs. 1,454 per month. Therefore, it is better to join early in the Scheme. The contribution levels, the age of entry and the pension amounts are available in a table given in frequently asked questions (FAQs) on APY, which is available on www.jansuraksha.gov.in.

5. The minimum age of joining APY is 18 years and maximum age is 40 years. Therefore, minimum period of contribution by any subscriber under APY would be 20 years or more.

Login to your netbanking account. Select 'Social Security Schemes' under 'My Account' tab. A new page will appear on your screen. Click 'select scheme' dropdown and choose Atal Pension Yojana. Then select your savings account number that you want to link with the scheme and submit. As soon as you submit this page, you get an option to select the Customer Identification (CIF) number. Select the CIF generated which is system generated and submit.

After this step, an e-form will appear on your screen. Follow the instructions given on the screen. Your bank details and personal information shared with the bank during the time of opening your account will be picked automatically. However there will be a few tabs seeking additional contact information like email address, Aadhar number which was not made available to the bank while opening the account. It is not mandatory to provide Aadhaar number for opening APY account.It is however desirable to provide Aadhaar Number for proper identification of the subscriber. Below the personal details tab, you'll get the option of filing the nominee details. After filing the nominee details select the pension details; Pension amount, Contribution Periodicity which can be monthly, quarterly or half yearly and the contribution amount. Fill in all the details carefully and submit and download the acknowledgement.

You may e-subscribe for APY with a few clicks, but there's no option to unsubscribe for it online. To discontinue APY, you need to visit your bank's home branch which involves a little paperwork and can be a tiresome task.

Under the APY, there is guaranteed minimum monthly pension for the subscribers ranging between Rs. 1000 and Rs. 5000 per month.

• The benefit of minimum pension would be guaranteed by the GoI.

• GoI will also co-contribute 50% of the subscriber’s contribution or Rs. 1000 per annum, whichever is lower. Government co-contribution is available for those who are not covered by any Statutory Social Security Schemes and is not income tax payer.

• GoI will co-contribute to each eligible subscriber, for a period of 5 years who joins the scheme between the period 1st June, 2015 to 31st December, 2015. The benefit of five years of government Co-contribution under APY would not exceed 5 years for all subscribers including migrated Swavalamban beneficiaries. • All bank account holders may join APY.

• APY is applicable to all citizen of India aged between 18-40 years.

• Aadhaar will be the primary KYC. Aadhar and mobile number are recommended to be obtained from subscribers for the ease of operation of the scheme. If not available at the time of registration, Aadhar details may also be submitted later stage.

• Citizens of India between the age groups of 18-40 years can apply.

• The applicant is expected to regularly pay premiums for a minimum duration of 20 years. Since most individuals step into the pension years at the age of 60- the upper limit for application is set at 40 years.

• The applicant must have an active savings bank account.

• The applicant must not have subscribed to any other statutory social security schemes.

• Actual pension amount depends on the tenure of premium payment. The higher number of premiums paid, the higher will be the payable pension amount.

• Age of joining and contribution period 4.1 The minimum age of joining APY is 18 years and maximum age is 40 years. The age of exit and start of pension would be 60 years. Therefore, minimum period of contribution by the subscriber under APY would be 20 years or more.

• Approach the bank branch/post office where your savings bank account is held or open a savings account if you don't have one and fill up the APY registration form.

• If you are a net savvy user, you can get enrolled for APY through your savings account directly using internet banking and choose auto debit facility for your contributions. The premium will be debited from your age of enrolment till 60 years.

Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Re 1 per month to Rs 10/- per month as shown below:

• Re. 1 per month for contribution upto Rs. 100 per month.

• Re. 2 per month for contribution upto Rs. 101 to 500/- per month.

• Re 5 per month for contribution between Rs 501/- to 1000/- per month.

• Rs 10 per month for contribution beyond Rs 1001/- per month. The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Discontinuation of payments of contribution amount shall lead to following:

• After 6 months account will be frozen.

• After 12 months account will be deactivated.

• After 24 months account will be closed. Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount.

On attaining the age of 60 years:

The exit from APY is permitted at the age with 100% annuitisation of pension wealth. On exit, pension would be available to the subscriber.

In case of death of the Subscriber due to any cause:

In case of death of subscriber pension would be available to the spouse and on the death of both of them (subscriber and spouse), the pension corpus would be returned to his nominee.

Exit before 60 years of age is not permitted however it is permitted only in exceptional circumstances, i.e., in the event of the death of beneficiary or terminal disease.

On death of a beneficiary before attaining 60 years of age, the nominee will receive monthly pension and will also receive lump-sum amount depending on the pension amount.

Monthly Pension of Rs 1000: 1.70 lakh

Monthly Pension of Rs 2000: 3.40 lakh

Monthly Pension of Rs 3000: 5.10 lakh

Monthly Pension of Rs 4000: 6.80 lakh

Monthly Pension of Rs 5000: 8.50 lakh

When the scheme was first launched, there was no tax exemption on the premium paid. However, a recent circular from the income tax department has instructed that contributions to Atal Pension Yojana will have similar benefits like NPS. It means that the premium paid is eligible for deduction under section 80CCD, with the upper limit capped at Rs. 50,000.

The following table illustrates the monthly contribution and the returns for each monthly pension slab.

The objective of APY is to give old age income security for the working poor. As, 88% of the labor does not have a formal pension scheme so, APY is focused on the unorganised sector worker.

A pension of 1k, 2k, 3k, 4k or 5k would be given depending on the contribution.

Some of the key features are:

1. entry age is 18–40 years

2. the person has to have a savings account

3. contribution would be eligible for same tax benefit as NPS.

4. Before the age of 60 voluntary exit is allowed but you have to give penalty.