www.mytaxcollector.com Payment : Tax Collector – Pay Online

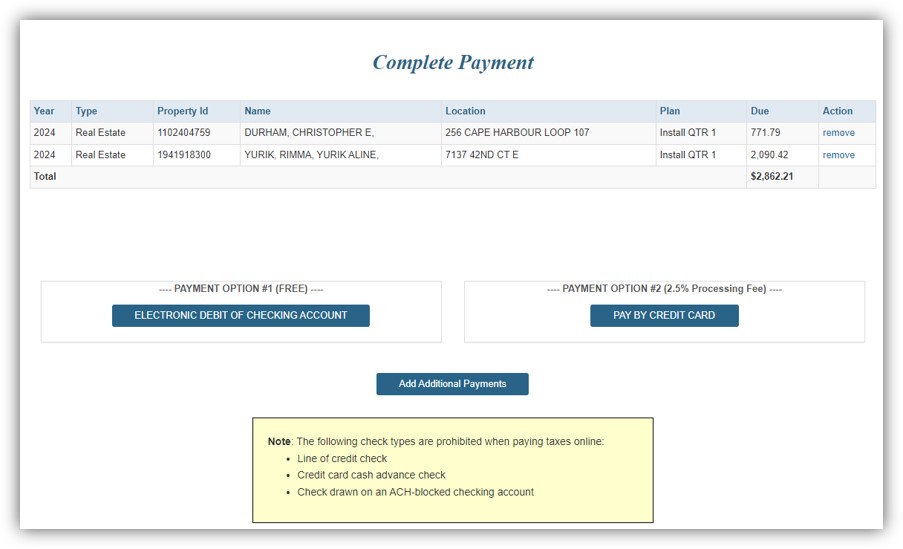

In order to provide the most secure and prompt service, the tax collector at www.mytaxcollector.com recommends paying your property tax bill(s) online using eCheck.

By doing so, Tax Collector provide IMMEDIATE confirmation that your payment has been received and credited to your account. No more checks lost in the mail. We used the same encryption security as banks, so you can be certain your transaction is safe and secure.

It is free to pay by eCheck using your United States checking or savings account. To pay with your checking or savings account, you will need your routing and account number.

You may also pay with your VISA, MasterCard, Discover or American Express card. Payment via credit card is subject to a convenience fee. The convenience fee is not retained by the Tax Collector.

If Unable to Pay Online, Mail a Check :

Please be advised that if for any reason you are unable to make your tax payment electronically online, or over the phone, you are still responsible to make payments timely in order to avoid penalties.

Tax Collector accept mailed payments as timely if they are postmarked by the USPS on or before the delinquent date.

How do I make, cancel, or view an appointment?

Appointments may only be scheduled through our online appointment system. Tax Collector will not schedule appointments by phone or email. For those who need assistance making any type of appointment, visit our Driver License Office where a specially trained associate in the lobby will assist you in scheduling an appointment for a future visit.

Spouses, family members, etc. must schedule separate appointments. Up to 4 transactions may be processed per appointment. Scheduling multiple appointments will result in all of your appointments being cancelled without notice.

To ensure a one-time visit to our office, view important transaction requirements here.

DRIVER LICENSE TRANSACTIONS – MANDATORY APPLICATION here.

An Online Application is REQUIRED for all transactions! To complete your driver license or ID card transaction at one of our offices, you must complete the Online Driver License & ID Card Application prior to your appointment. Do not print the application; an associate will access your electronic submission during your appointment. Applications are valid for 90 days.

DRIVING SKILLS ROAD TEST (CLASS E) REQUIREMENTS here

CONCEALED WEAPON LICENSE REQUIREMENTS here

Do you need to cancel or reschedule your appointment?

Click here to cancel, reschedule, or view your appointment. You will need to enter the mobile number used during booking to locate your scheduled appointment and make the necessary changes by following the prompts.

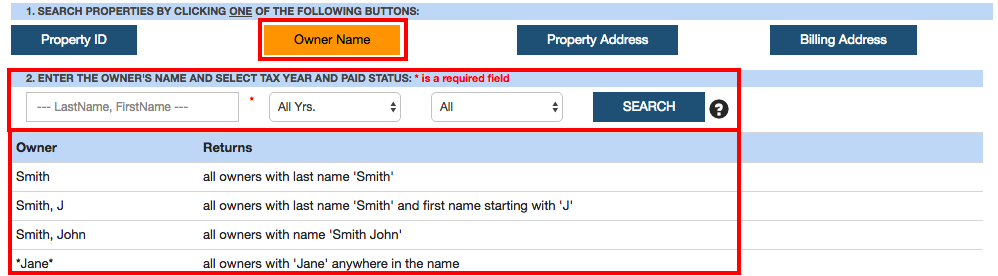

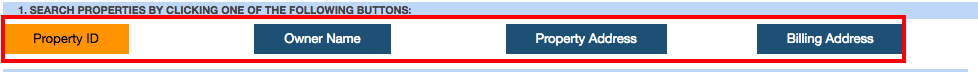

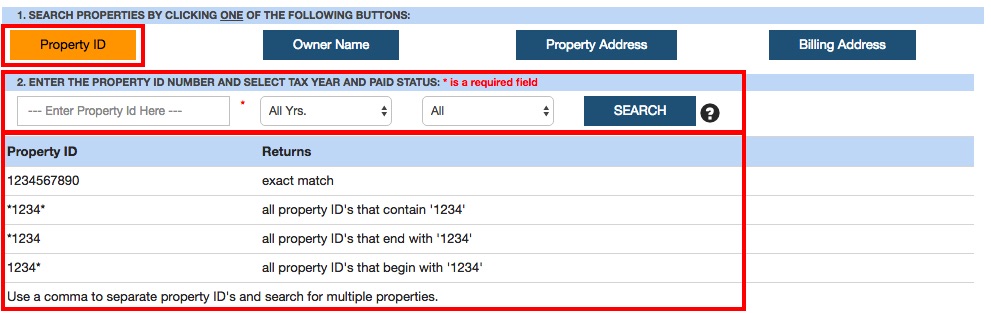

How to Search for an Account

To pay taxes online, you must first locate the account(s) by following these steps:

button located in the far left column in the row for that property.