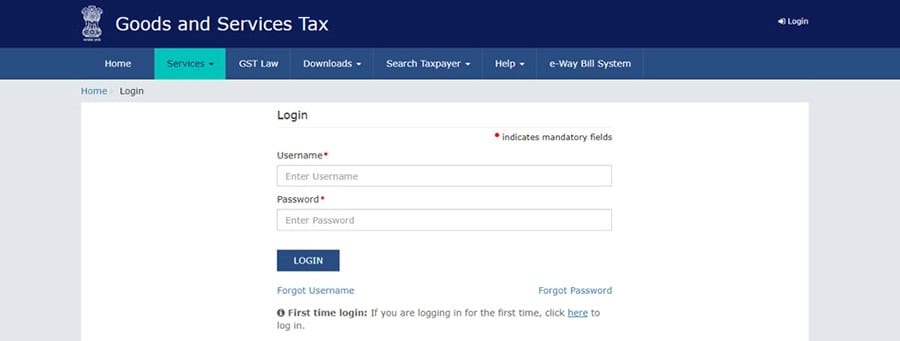

https //www.gst.gov.in Login dashboard : E-WayBill System Login, Pay GST Tax, GST Portal

To access your GST account, go to www.gst.gov.in or the official GST website and look for the “Login” button on the right side of the screen. After you’ve entered your login information (username, password, and captcha code), click the “LOGIN” button.

Electronic Way Bill (E-Way Bill) is basically a compliance mechanism wherein by way of a digital interface the person causing the movement of goods uploads the relevant information prior to the commencement of movement of goods and generates e-way bill on the GST portal.

As per the notification dated 22 December 2020, No. 94 /2020. the validity period of e-waybill will be changed from 100 KM per day to 200 KM per day from 01/01/2021.

How to Make E Way Bill

Step 1:

Login to eway bill system.

Enter the Username, password and Captcha code, Click on ‘Login’

Step 2:

Click on ‘Generate new’ under ‘E-waybill’ option appearing on the left-hand side of the dashboard.

Step 3:

Enter the following fields on the screen that appears:

1) Transaction Type:

Select ‘Outward’ if you are a supplier of consignment

Select ‘Inward’ if you are a recipient of consignment.

2) Sub-type: Select the relevant sub-type applicable to you:

If transaction type selected is Outward, following subtypes appear:

If transaction type selected is Inward, following subtypes appear:

Note: SKD/CKD- Semi knocked down condition/ Complete knocked down condition

3) Document type: Select either of Invoice / Bill/ challan/ credit note/ Bill of entry or others if not Listed

4) Document No. : Enter the document/invoice number

5) Document Date: Select the date of Invoice or challan or Document.

Go Fashion IPO : Go Fashion IPO Date, Share Price, Listing Price, Launch Date

Note: The system will not allow the user to enter the future date.

6) From/ To Depending on whether you are a supplier or a recipient, enter the To / From section details.

Note: If the supplier/client is unregistered, then mention ‘URP’ in the field GSTIN, indicating that the supplier/client is an ‘Unregistered Person’.

7) Item Details: Add the details of the consignment (HSN code-wise) in this section:

• Product name

• Description

• HSN Code

• Quantity,

• Unit,

• Value/Taxable value

• Tax rates of CGST and SGST or IGST (in %)

• Tax rate of Cess, if any charged (in %)

• Eway bill

Note: On the implementation of Eway bills, Based on the details entered here, corresponding entries can also be auto-populated in the respective GST Return while filing on GST portal.

8) Transporter details: The mode of transport(Road/rail/ship/air) and the approximate distance covered (in KM) needs to be compulsorily mentioned in this part.

Apart from above, Either of the details can be mentioned:

Transporter name, transporter ID, transporter Doc. No. & Date.

OR

Vehicle number in which consignment is being transported.

Format: AB12AB1234 or AB12A1234 or AB121234 or ABC1234

Note: For products, clients/customers, suppliers, and transporters that are used regularly, first update the ‘My masters’ section also available on the login dashboard and then proceed.

Step 4:

Click on ‘Submit’. The system validates data entered and throws up an error if any.

Otherwise, your request is processed and the eway bill in Form EWB-01 form with a unique 12 digit number is generated.

Who should Generate an eWay Bill?

• Registered Person –

Eway bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a registered person. A Registered person or the transporter may choose to generate and carry eway bill even if the value of goods is less than Rs 50,000.

• Unregistered Persons –

Unregistered persons are also required to generate e-Way Bill. However, where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the supplier.

• Transporter –

Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.

Cases when eWay bill is Not Required

In the following cases it is not necessary to generate e-Way Bill:

1. The mode of transport is non-motor vehicle

2. Goods transported from Customs port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

3. Goods transported under Customs supervision or under customs seal

4. Goods transported under Customs Bond from ICD to Customs port or from one custom station to another.

5. Transit cargo transported to or from Nepal or Bhutan

6. Movement of goods caused by defence formation under Ministry of defence as a consignor or consignee

7. Empty Cargo containers are being transported

8. Consignor transporting goods to or from between place of business and a weighbridge for weighment at a distance of 20 kms, accompanied by a Delivery challan.

9. Goods being transported by rail where the Consignor of goods is the Central Government, State Governments or a local authority.

10. Goods specifed as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

11. Transport of certain specified goods- Includes the list of exempt supply of goods, Annexure to Rule 138(14), goods treated as no supply as per Schedule III, Certain schedule to Central tax Rate notifications.

FAQs

1.What is verification of vehicle number in EWB Portal?

Ans: E-Way bill has been integrated with Vahan System of Transport Department. Vehicle number entered in e-way bill will now be verified with the Vahan System. If Vehicle no. is not available in the Vahan system user will get ‘Alert Message’ about the non-availability of vehicle number in vahan database. However, later, such vehicle numbers will not be allowed for the generation of e-way bill.

2. Why am I getting alert message when I enter vehicle number in E-way Bill?

Ans: The vehicle number entered in the EWB is not available in Vahan Database, you are requested to check and update the vehicle registration with your concerned Regional Transport Office (RTO), otherwise after sometime this vehicle number will not be allowed for e-way bill generation.

3. When I enter Vehicle number, I get a message that Vehicle is registered in more than one RTO, what should I do ?

Ans: This message indicates that the Vehicle details are found in more than one RTOs. You need to approach your RTO and request for updation of the office. Once the details are updated this message will not appear again. Not doing so , later it will be treated as Vehicle no. is not existent and may not be allowed for e-waybill generation.

4. In spite of having a Valid RC of my Vehicle, I am getting alert message from e-waybill portal. What can I do?

Ans: In case, Vehicle number entered in the e-waybill is registered and system still showing ‘Alert Message’ it is suggested to reach to your concerned RTO. Once the vehicle details are updated in Vahan system, the status in e-Waybill system will subsequently get updated.

Be the first to comment