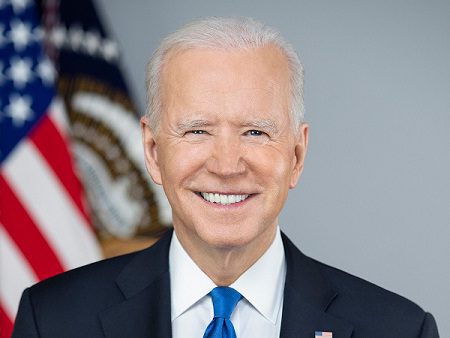

Student • Student loan • Joe Biden • Finance • Student debt

Loan Forgiveness Student Loans: Borrowers of federal student loans had the lowest interest rates on their loans in history two years ago. Undergraduate borrowing rates will be roughly double what they were in 2020-21 this fall.

For the 2022-23 academic year, interest rates on new undergraduate direct federal student loans will rise to 4.99 percent, up from 3.73 percent last year and 2.75 percent in 2020-21. Graduate direct loan interest rates will likewise climb to 6.54 percent, while parent and graduate PLUS loan interest rates will jump to 7.54 percent.

Since the higher interest rates take effect on July 1, any new loans taken out prior to that date will be subject to the rates in force for the 2021-22 academic year.

Borrowers who take on graduate direct and PLUS loans will see their borrowing costs rise even more. PLUS loans feature a 4.23 percent origination fee and no borrowing restrictions, in addition to higher interest rates.

The average PLUS loan in 2019 was roughly $14,000, according to the Hechinger Report, a nonprofit focused on education issues. With a conventional 10-year term and a 7.54 percent interest rate next year, the loan amount will cost $19,977 over the life of the loan, including $5,977 in interest.

The Treasury Department’s 10-year note auction in May determines interest rates for federal student loans. The 2.94 percent interest rate on the May 10-year notes is added to margins set by Congress, which vary between forms of federal student loans.

The interest rate on undergraduate direct loans is increased by 2.05 percentage points; graduate student loans are increased by 3.6 percentage points, and PLUS loans are increased by 4.6 percentage points.

Read Also : safelink.com My Account

Gathering the Documents Needed to Apply

The FAFSA questions ask for information about you (your name, date of birth, address, etc.) and about your financial situation. Depending on your circumstances (for instance, whether you’re a U.S. citizen or what tax form you used), you might need the following information or documents as you fill out the application:

Your Social Security number (it’s important that you enter it correctly on the FAFSA form!)

Your parents’ Social Security numbers if you are a dependent student

Your driver’s license number if you have one

Your Alien Registration number if you are not a U.S. citizen

Federal tax information or tax returns including IRS W-2 information, for you (and your spouse, if you are married), and for your parents if you are a dependent student:

- IRS 1040

- Foreign tax return, IRS 1040NR, or IRS 1040NR-EZ

- Tax return for Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, the Marshall Islands, the Federated States of Micronesia, or Palau

Records of your untaxed income, such as child support received, interest income, and veterans noneducation benefits, for you, and for your parents if you are a dependent student

Information on cash; savings and checking account balances; investments, including stocks and bonds and real estate (but not including the home in which you live); and business and farm assets for you, and for your parents if you are a dependent student

Also Read : funimation/activate Xbox,

FAFSA® Filing Options

You may choose any of these methods to file a FAFSA form:

Log in at fafsa.gov to apply online or

Fill out the form in the myStudentAid mobile app, available on the App Store (iOS) or Google Play (Android) or

Complete a 2021-22 FAFSA PDF (note: you must print out and mail the FAFSA PDF for processing) or

Request a print-out of the FAFSA PDF by calling us at 1-800-4-FED-AID (1-800-433-3243); then fill out the form and mail it for processing

Also Read : PS4 Error NP-34958-9 Server Communication Error, Belk Credit Card Login, https //outlook.office.com Login Account, https //ksupport.kiausa.com/consumeraffairs/swld