Student Loan Forgiveness Application 2022 : One-time Federal Student Loan Debt Relief

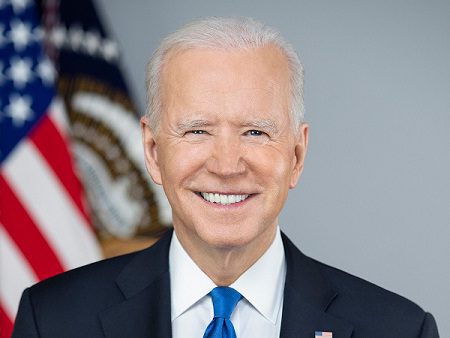

Despite Vice President Biden’s belief that a post-secondary education should be a passport to a middle-class existence, the expense of borrowing for college has become a lifetime burden for far too many people. He campaigned on a platform of helping students with their debt. As promised, the Biden administration is now helping families recover from the financial hardship caused by the pandemic by giving them more time to begin repaying loans.

Borrowers can sign up to be notified when this information is available at StudentAid.gov/debtrelief.

President Biden is proposing a three-pronged strategy today to help American working families recover from the stresses of the recent COVID-19 outbreak. As part of a larger attempt to alleviate the financial strain of rising tuition and make the student loan system more workable for middle-class families, this idea provides individualised debt relief.

If all borrowers claim the relief they are entitled to, these actions will:

- Provide relief to up to 43 million borrowers, including cancelling the full remaining balance for roughly 20 million borrowers.

- Target relief dollars to low- and middle-income borrowers. The Department of Education estimates that, among borrowers who are no longer in school, nearly 90% of relief dollars will go to those earning less than $75,000 a year. No individual making more than $125,000 or household making more than $250,000 – the top 5% of incomes in the United States – will receive relief.

- Help borrowers of all ages. The Department of Education estimates that, among borrowers who are eligible for relief, 21% are 25 years and under and 44% are ages 26-39. More than a third are borrowers age 40 and up, including 5% of borrowers who are senior citizens.

- Advance racial equity. By targeting relief to borrowers with the highest economic need, the Administration’s actions are likely to help narrow the racial wealth gap. Black students are more likely to have to borrow for school and more likely to take out larger loans. Black borrowers are twice as likely to have received Pell Grants compared to their white peers. Other borrowers of color are also more likely than their peers to receive Pell Grants. That is why an Urban Institute study found that debt forgiveness programs targeting those who received Pell Grants while in college will advance racial equity.

Also Read : How To Defer Student Loans Nelnet

Student Loan Forgiveness Application 2022 :

The Biden-Harris Administration is providing up to $20,000 in student loan debt relief for eligible borrowers.

Apply today (but no later than Dec. 31, 2023).

Borrowers can sign up to be notified when this information is available at StudentAid.gov/debtrelief.

How Much Debt Relief You Can Get

Up to $20,000 in debt relief if you received a Federal Pell Grant in college and meet the income requirements

Up to $10,000 in debt relief if you didn’t receive a Federal Pell Grant in college and meet the income requirements

The debt relief applies only to loan balances you had before June 30, 2022. Any new loans disbursed on or after July 1, 2022, aren’t eligible for debt relief.

Will my debt relief be taxed?

One-time student loan debt relief won’t be taxed at the federal level. Some states may be taxing this debt relief, so check with your state of residence for the latest information. (See below, “What if I don’t want to receive debt relief?”)

See if You Qualify

You may receive debt relief if you have eligible federal loans and meet the following income requirements:

Tax Filing Status | 2020 or 2021 Income (Based on AGI*) |

|---|---|

Did not file taxes | Made less than the required income to file federal taxes |

Single | Under $125,000 |

Married, filed your taxes separately | Under $125,000 |

Married, filed your taxes jointly | Under $250,000 |

Head of household | Under $250,000 |

Qualifying widow(er) | Under $250,000 |

Recently Enrolled Undergraduate Students

Here are some reasons you likely would be classified as a dependent student for federal student aid purposes:

You were enrolled as an undergraduate student between July 1, 2021, and June 30, 2022.

You were born after Jan. 1, 1998.

You aren’t married.

Which Loans Are Eligible

The following types of federal student loans disbursed (when you received your loan funds) on or before June 30, 2022, are eligible for relief:

William D. Ford Federal Direct Loan (Direct Loan) Program loans

Federal Family Education Loan (FFEL) Program loans held by ED or in default at a guaranty agency

Federal Perkins Loan Program loans held by ED

Defaulted loans (includes ED-held or commercially serviced Subsidized Stafford, Unsubsidized Stafford, parent PLUS, graduate PLUS; and Perkins loans held by ED)

How to Find Your Loans and Loan Servicers

Log in to StudentAid.gov and select “My Aid” in the dropdown menu under your name at the top right of your screen.

The “My Aid” section will show you the servicer(s) for your loans.

The “Loan Breakdown” will show you a list of the loans you received. You’ll also see loans you paid off or consolidated into a new loan. If you expand “View Loans” and select the “View Loan Details” arrow under a loan, you’ll see the more detailed name for that loan (along with other information about it).

Direct Loans begin with the word “Direct.” Federal Family Education Loan Program loans begin with “FFEL.” Perkins Loans include the word “Perkins” in the name. If the name of the servicer starts with “Dept. of Ed” or “Default Management Collection System,” your FFEL Program loan or Perkins Loan is federally managed (i.e., held by ED). Only federal loans are eligible for debt relief. Private loans aren’t eligible and won’t show on your dashboard.