Sansera Engineering IPO GMP Today Live : IPO Date, Price, GMP, Review, Details

Sansera Engineering, manufacturer of automobile components, coded a Rs 811.50 premium of 9% at Rs 744 per share on September 24. The stock was opened on the BSE at Rs 811.35, and the National Stock Exchange opening price was Rs 811.50.

The public edition of Rs 1,283, which opened between 14 and 16 September, received 11.47 subscriptions to 13.88 crore equity shares with an IPO size of 1.21 crore shares, creating offers worth Rs 10,329.62 crore.

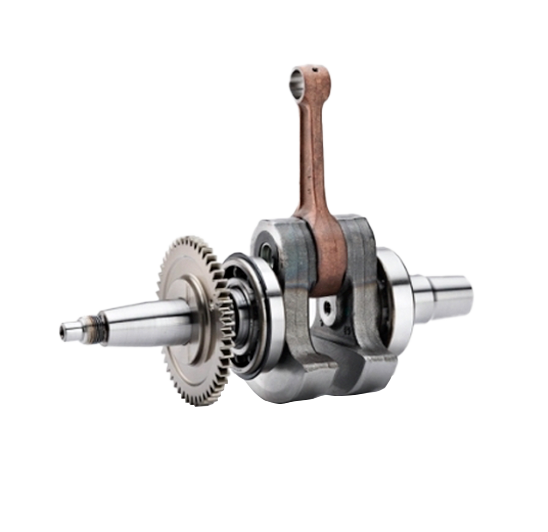

Sansera Engineering Limited is a complex precision-engineered component manufacturer that focuses on critical and complex aspects of their work in both the automotive and non-automotive markets. They provide a wide range of components and assemblies to the commercial vehicle, passenger vehicle, and two-wheeler industries, which include connecting rod, rocker arm, crankshaft, gear shifter fork, stem comp, and aluminium forged parts, as these components are crucial for engines, transmissions, suspensions, brakes, chassis, and other systems.

They are involved in the manufacture and supply of a variety of precise components for many industries, including aerospace, off-road, agriculture, and more, including industrial equipment and major manufacturing goods.

They rank among the top 10 global providers of connecting rods for light and commercial vehicles, with a share of 4.5% in the global light vehicle market for CY 2020.

Sensera Engineering’s public offer of shares consists of 1.72 crore shares being sold by existing stakeholders and company advocates.

Issue Period

Price Band ₹ 734-744 | Lot Size 20 shares |

IPO Schedule

| Issue Period | 14th September 2021 to 16th September 2021 |

| Finalization of Allotment | 21st September 2021 |

| Initiation of Refunds | 22nd September 2021 |

| Credit of Shares | 23rd September 2021 |

| Date of Listing | 24th September 2021 |

| Mandate End Date | 1st October 2021 |

Strengths

Leading supplier of complex and high-quality precision engineered components that is gaining market share |

Skilled and experienced board of directors and management team |

Financial performance that has outperformed the industry trends |

Risks

Failure to adapt to industry trends and evolving technologies |

Seasonal or economic cyclicality coupled with reduced demand in the verticals |

Lack of firm commitment, long-term supply agreements with the customers |

Be the first to comment