PNC Virtual Wallet Login : PNC Virtual Wallet Debit Card

First things first. For you to have access to everything Virtual Wallet has to offer, you can enroll in Online Banking. It’s quick and easy, and you’ll be able to view your account details.

Visit the Customer Service tab within Online Banking to order checks, set account preferences, and more.

Download the PNC Mobile app and verify your credentials to get started

For banking on the go, download and use the PNC Mobile app.

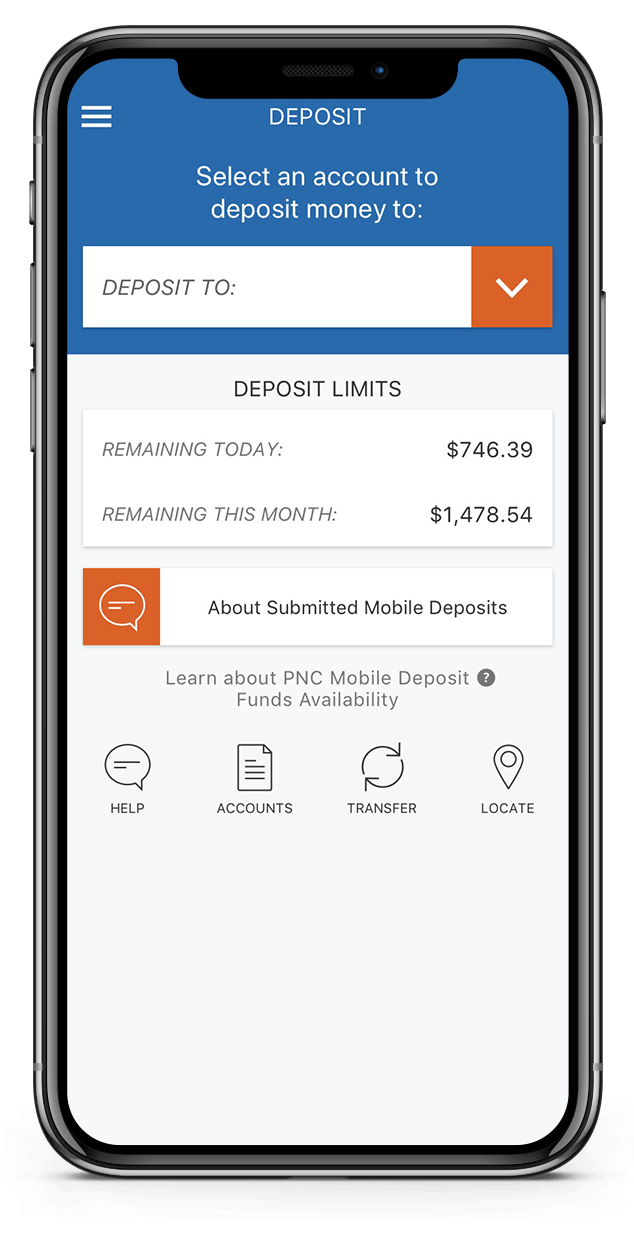

- You can deposit checks from your phone

- With just an email address or mobile phone number, you can quickly send money to people you know and trust, regardless of where they bank in the U.S. by using Zelle®

- Low Cash Mode® can help you avoid overdrafts on your Spend account by giving you Intelligent Alerts, Extra Time to bring your balance positive when it is negative, and more options and control with certain payment decisions.

- You can request a one-time PNC ATM access code – card not needed!

Fund Your Account

Next, fund your account so you can make the most of Virtual Wallet’s budgeting and bill pay features. You have a few funding options. You can:

- Set up direct deposit

- For direct deposit, you’ll need your account and routing numbers. To find those numbers, sign on to PNC Online Banking and go to the Account Activity for your new Spend account.

- Deposit a check from your phone using the PNC Mobile App. PNC Express Funds gives you the option, for a fee, to make the full amount available immediately for withdrawals and purchases.

- Deposit checks or cash at a nearby branch or PNC ATM

- Transfer money from another account

Step 3

Mark Your Calendar

This is the bill payment and cash flow hub for your Virtual Wallet. Here’s how to set it up:

Add your bills

Start by adding your payees, such as your phone company, landlord, or even a friend. Then, schedule payments on a one-time or recurring basis.

Track other payments

Next, track any pre-authorized payments automatically withdrawn from your account – like a mortgage payment or a gym membership. If you write checks, you can also input and keep track of those until they’re cashed.

Plan your paydays

Add your payday to your calendar and see how much you have left to spend. It also helps to calculate possible Danger Days

Know about Danger Days

Danger Days show up on your Calendar when your Spend account is at risk of being overdrawn. To reduce your risk of overdrawing, you can make a deposit, transfer available money from another account or, if you can, change the day a bill is paid.

Step 4

Meet Your Money Bar®

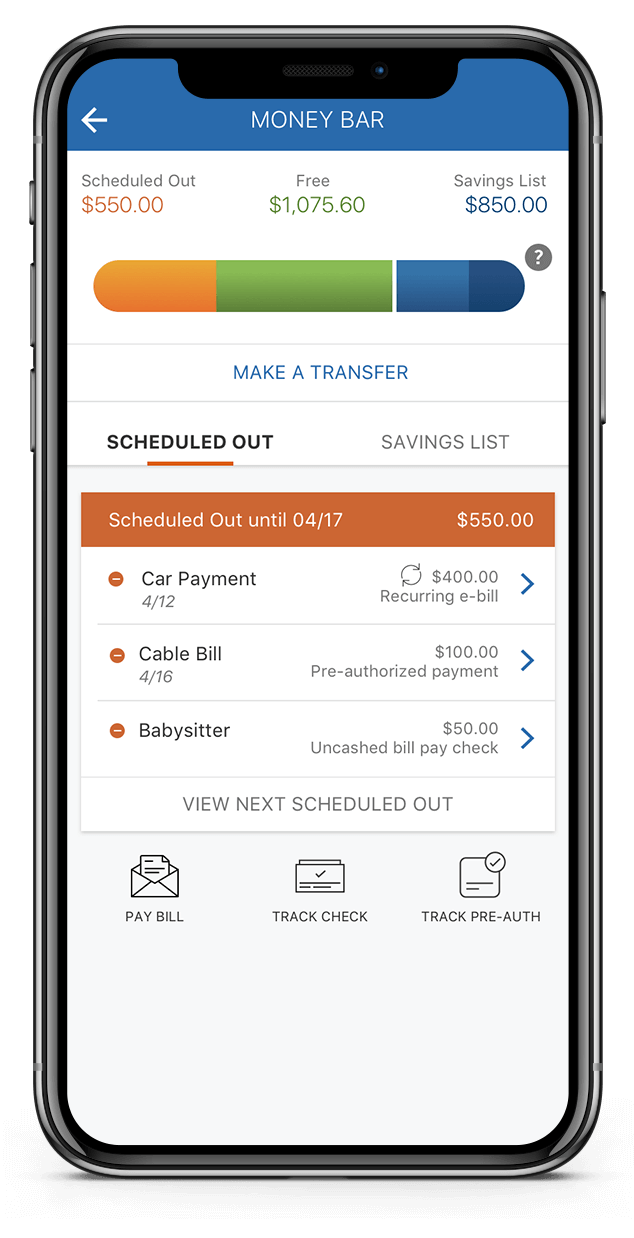

Once you’ve set up your Calendar, you can get familiar with your Money Bar.

Money Bar can help you see the money you have in your Spend and Reserve accounts until your next payday.

Your money is separated into four different buckets:

Scheduled Out

The part of your Spend account that adds up all the bills and other expenses you’ve input and tracked on your Calendar.

Free

How much you have left in your Spend account minus the bills and other expenses you have Scheduled Out.

Reserve

The money you put into your Reserve account.

Reserve Savings List

The money you’ve set aside in your Savings Goals.

Step 5

Save & Budget

Once your Calendar is ready and you know more about the Money Bar, there are a few other features you can set up to make the most of your new Virtual Wallet.

Create Savings Goals

Savings Goals help you save for the things you want and put away money for what you need. Create goals in your Reserve and Growth accounts to save for anything, from a new TV to an upcoming vacation. You can track your progress and move the money to your other accounts when you’re ready to spend.

Automate Your Savings

Create Savings Rules to automatically move money from your Spend to your savings on a regular basis. You can create five types of rules: Weekly, Bi-weekly, Monthly, Payday, and Bill Pay.

Once you create your new rule, it will be added to your Calendar and Scheduled Out.

Build Your Budgets

You can set budgets to track your spending by category, like groceries, restaurants and pets. You’ll see how much you’ve spent in each category during the month and how much you have left to spend.

Set up budget alerts to get an email when you’re close to reaching your max budget. Plus, a PNC credit card can be linked to your Virtual Wallet within PNC Online Banking, so you can see your spending all in one place.

Be the first to comment