paycor.com Register Login : How to Login to Paycor?

To Register your Paycor account, go to hcm.paycor.com/Accounts/Registration. You’ll need to enter a few pieces of personal information so Paycor can verify your identify. If you have previously created other paycor.com accounts, you can merge this account’s access code by signing in when prompted.

If you’re a payroll or HR admin using Paycor software, or you’re an employee of a company that partners with Paycor, this section will answer almost any question you can think of. If you don’t see your question here, visit the Paycor Support Center to contact Paycor or use our enhanced knowledge base.

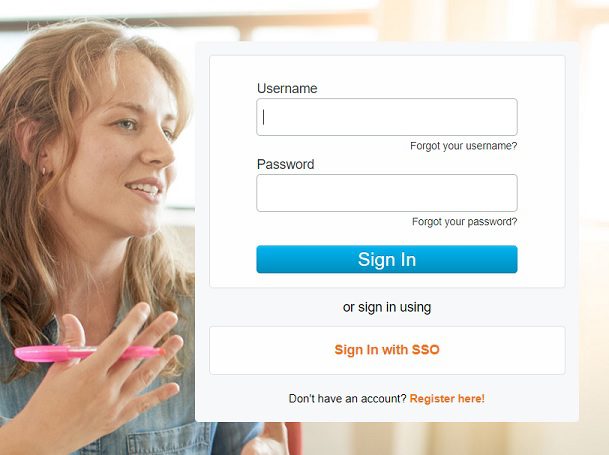

Paycor Login

Here are some helpful tips to view your employee information in Paycor.

- Go to www.paycor.com and click Sign In.

- Enter your User Name and Password and click the Sign In button.

- Hover over Me. Then, click on Profile Summary.

Here, you can view specific details about you, including your contact information, paystubs and compensation history.

Change password:

- Sign in on https://hcm.paycor.com/authentication/signin with your existing password

- Click on My Settings in the top right corner

- Under Security, click on the link to “Change Your Password…“

Forgot or don’t know your password:

- Go to www.paycor.com, and click on Sign In.

- Skip the Username and Password fields

- Click on the “Forgot your Password?” link

- Then follow the on-screen instructions

Update direct deposit information:

We can help with that. But first, your company HR or payroll administrator must grant you access to edit your direct deposit information. Once you’ve received access:

- Go to www.paycor.com, and click on Sign In.

- From the menu, go to Profile Summary

- Click on Compensation

- Click on Direct Deposits

- Update your information

If you need immediate help, please reach out to your company administrator.

When will my W-2 be available?

Paycor will mail all W-2 forms before the end of January. Your W-2 will be available online at www.paycor.com within four days of leaving Paycor’s offices (roughly around the same time you receive a physical copy in the mail). You can download or print your W-2 from www.paycor.com at that time.

Note: If you can’t access your W-2 online or have not received a physical copy by January 31, contact your employer’s HR administrator.

For Administrators

How to find your Client ID:

- To find your client ID, navigate to your Pay Employee or Configure Company menu options under the Company tab.

- At the top, under the tabs, you will see what client ID you are logged in to.

- You can also navigate to the Home tab and you will see the current Client ID that you are logged into just below the blue “Contact Us” button.

New employee info, taxes:

It is necessary to add a tax code at the company level first in order to later use that tax code for an employee.

If you wish to edit whether a tax is currently calculating for an employee, change the Calculate setting between ON or OFF.

Steps:

- Click Manage Employees.

- Double-click the employee receiving a new deduction.

- Click Compensation from the navigation menu on the left.

- Select Taxes.

- System will display taxes already assigned to the employee and their default details. Make any necessary changes.

- Review the settings, and then click Save.

Download Guide: Taxes

If configuring Taxes for a member of the Clergy, download this guide: Tax Setup for Clergy (Manage Employees)

How to set up a 1099 employee:

An individual may receive a 1099 for a variety of reasons with the most common being they are an independent contractor for a company.

The type of 1099 may vary based on from where the income is coming. Typical reasons for a 1099 come from Independent Contractors, interest and dividends, withdrawals on retirement account, rent, royalties, or even some government payments.

Steps:

- Set up the appropriate 1099 earning code

- Configure Settings then Save

- Add the policy to an employee