Middle Class Tax Refund Status Update How to Check: Who gets the California gas tax refund?

The Middle Class Tax Refund (MCTR) is a one-time payment to provide relief to Californians.

If you are eligible, you will automatically receive a payment. Payments are expected to be issued between October 2022 and January 2023.

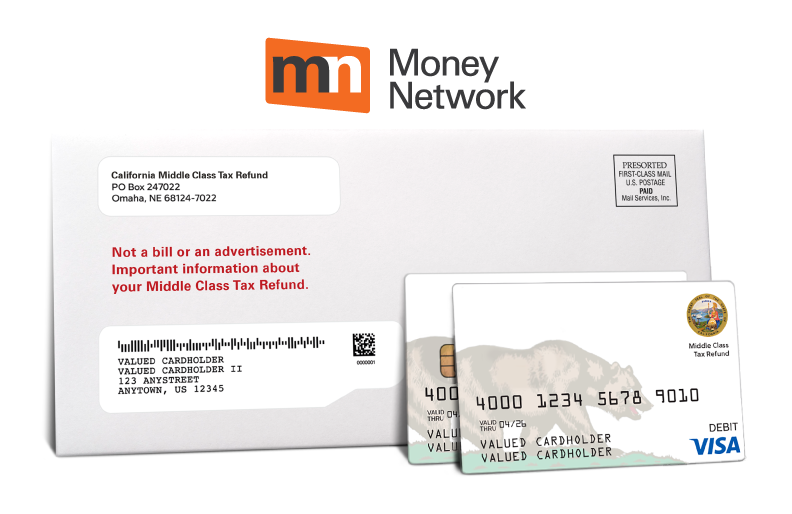

Some taxpayers will receive their payment on a debit card.

FTB has partnered with Money Network to provide payments distributed by debit card.

Determine your eligibility

You are eligible if you:

- Filed your 2020 tax return by October 15, 2021.

- Meet the California adjusted gross income (CA AGI) limits described in the What you may receive section

- Were not eliglible to be claimed as a dependent in the 2020 tax year

- Were a California resident for six months or more of the 2020 tax year

- Are a California resident on the date the payment is issued

How you’ll receive your payment

Californians will receive their MCTR payment by direct deposit or debit card.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. MCTR debit card payments will be mailed to the remaining eligible taxpayers.

You will receive your payment by mail in the form of a debit card if you:

- Filed a paper return.

- Had a balance due.

- Received your Golden State Stimulus (GSS) payment by check.

- Received your tax refund by check regardless of filing method.

- Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number.

- Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund.

When you’ll receive your payment

MCTR direct deposit payments for Californians who received GSS I or II are expected to be issued to bank accounts between October 7, 2022 and October 25, 2022. The remaining direct deposits will occur between October 28, 2022 and November 14, 2022.

MCTR direct deposit recipients who have changed their banking information since filing their 2020 tax return will receive a debit card. Debit cards for this group will be mailed between December 17, 2022 and January 14, 2023.

MCTR debit card payments for Californians who received GSS I and II are expected to be mailed between October 25, 2022 and December 10, 2022. The remaining debit cards will be mailed by January 14, 2023.

Refer to the tables below for the latest updates to the payment schedules.

| Recipients | Payment issue date |

|---|---|

| GSS I or II direct deposit recipients | 10/07/2022 through 10/25/2022 |

| Non-GSS recipients | 10/28/2022 through 11/14/2022 |

| Recipients | Debit card mailing timeframe |

|---|---|

| GSS I or II check recipients (last name beginning with A – E) | 10/24/2022 through 11/05/2022 |

| GSS I or II check recipients (last name beginning with F – M) | 11/06/2022 through 11/19/2022 |

| GSS I or II check recipients (last name beginning with N – V) | 11/20/2022 through 12/03/2022 |

| GSS I or II check recipients (last name beginning with W – Z) | 12/04/2022 through 12/10/2022 |

| Non-GSS recipients (last name beginning with A – L) | Will be announced after 11/07/2022 |

| Non-GSS recipients (last name beginning with M – Z) | Will be announced after 11/21/2022 |

| Direct deposit recipients who have changed their banking information since filing their 2020 tax return | 12/17/2022 through 01/14/2023 |

Direct deposits typically occur within 3-5 business days from the issue date, but may vary by financial institution.

Allow up to 2 weeks from the issue date to receive your debit card by mail.

We expect about 90% of direct deposits to be issued in October 2022.

We expect about 95% of all MCTR payments — direct deposit and debit cards combined — to be issued by the end of this year.

What you may receive

Refer to the tables below to determine your payment amount.

For your CA AGI, go to:

- Line 17 on your 2020 Form 540

- Line 16 on your 2020 Form 540 2EZ

| CA AGI reported on your 2020 tax return | Payment with dependent | Payment without dependent |

|---|---|---|

| $150,000 or less | $1,050 | $700 |

| $150,001 to $250,000 | $750 | $500 |

| $250,001 to $500,000 | $600 | $400 |

| $500,001 or more | Not qualified | Not qualified |

| CA AGI reported on your 2020 tax return | Payment with dependent | Payment without dependent |

|---|---|---|

| $150,000 or less | $700 | $350 |

| $150,001 to $250,000 | $500 | $250 |

| $250,001 to $500,000 | $400 | $200 |

| $500,001 or more | Not qualified | Not qualified |

| CA AGI reported on your 2020 tax return | Payment with dependent | Payment without dependent |

|---|---|---|

| $75,000 or less | $700 | $350 |

| $75,001 to $125,000 | $500 | $250 |

| $125,001 to $250,000 | $400 | $200 |

| $250,001 or more | Not qualified | Not qualified |

Customer support is available in English, Spanish, Mandarin, Hindi, Vietnamese, Korean, and Punjabi. Other languages may be supported by request.

Phone : 800-542-9332

Weekdays, 8 AM to 5 PM

Be the first to comment