https //www.medicare.gov Login : How do I Access my Medicare account?

To login with Medicare, access the webpage www.medicare.gov to get your coverage. Once you enroll, you’ll need to decide how you’ll get your Medicare coverage.

Medicare is the federal health insurance program for:

- People who are 65 or older.

- Certain younger people with disabilities.

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).

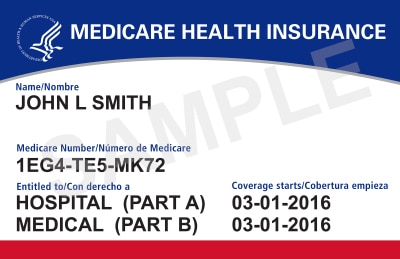

What are the parts of Medicare?

The different parts of Medicare help cover specific services:

- Medicare Part A (Hospital Insurance).

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. - Medicare Part B (Medical Insurance).

Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. - Medicare Part D (prescription drug coverage).

Helps cover the cost of prescription drugs (including many recommended shots or vaccines).

Login URL : https://www.medicare.gov/account/login

How does Medicare work?

With Medicare, you have options in how you get your coverage. Once you enroll, you’ll need to decide how you’ll get your Medicare coverage. There are 2 main ways:

Original Medicare

Medicare Part A covers hospital expenses while Medicare Part B covers medical services. As you use them, you make payments for services. You’ll have an annual deductible to meet before Medicare will cover any of your healthcare costs, and you’ll also have to pay coinsurance, which is typically 20% of the price of each Medicare-approved service you receive. You can sign up for a different drug plan (Part D) if you need prescription drug coverage.

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn’t cover, like emergency medical care when you travel outside the U.S.

Medicare Advantage

Medicare Advantage is Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Also Read : https //access.va.gov Travel Claim

Medicare prescription drug coverage (Part D)

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

Each plan can vary in cost and specific drugs covered, but must give at least a standard level of coverage set by Medicare. Medicare drug coverage includes generic and brand-name drugs. Plans can vary the list of prescription drugs they cover (called a formulary) and how they place drugs into different “tiers” on their formularies.

Plans have different monthly premiums. You’ll also have other costs throughout the year in a Medicare drug plan. How much you pay for each drug depends on which plan you choose.

How Medicare works with other insurance

and other health insurance (like from a group health plan, retiree coverage, or Medicaid), each type of coverage is called a “payer.” When there’s more than one payer, “coordination of benefits” rules decide who pays first. The “primary payer” pays what it owes on your bills first, and then sends the rest to the “secondary payer” (supplemental payer) to pay. In some rare cases, there may also be a third payer.

What it means to pay primary/secondary

- The insurance that pays first (primary payer) pays up to the limits of its coverage.

- The one that pays second (secondary payer) only pays if there are costs the primary insurer didn’t cover.

- The secondary payer (which may be Medicare) may not pay all the remaining costs.

- If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they’ll pay.

If the insurance company doesn’t pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should’ve made.

How Medicare coordinates with other coverage

If you have questions about who pays first, or if your coverage changes, call the Benefits Coordination & Recovery Center at 1-855-798-2627 (TTY: 1-855-797-2627). Tell your doctor and other health care provider about any changes in your insurance or coverage when you get care.

When can I buy Medigap?

The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first month you have Medicare Part B (Medical Insurance) and you’re 65 or older. It can’t be changed or repeated. After this enrollment period, you may not be able to buy a Medigap policy. If you’re able to buy one, it may cost more due to past or present health problems.