https //www.income tax india efiling.gov.in : Income Tax Login

The Income-Tax Department has already asked the taxpayers to link their Aadhaar with their PAN (Permanent Account Number) by 31 March this year to get seamless services online.

The I-T Department has shown three methods through which one can link PAN with Aadhaar: SMS, e-filing portal and while e-filing Income Tax Return.

E-Filing Aadhar Link : Live Updates

Link PAN-Aadhaar via SMS

A PAN can be linked with an Aadhaar number using SMS. For this, the tax payer has to send an SMS to 567678 or 56161 in the following format, says the Income Tax Department website:

UIDPAN<space><12-digit Aadhaar><space><10-digit PAN>

For example, UIDPAN 111122223333 AAAPA9999Q

You can link your PAN with Aadhaar by following process:

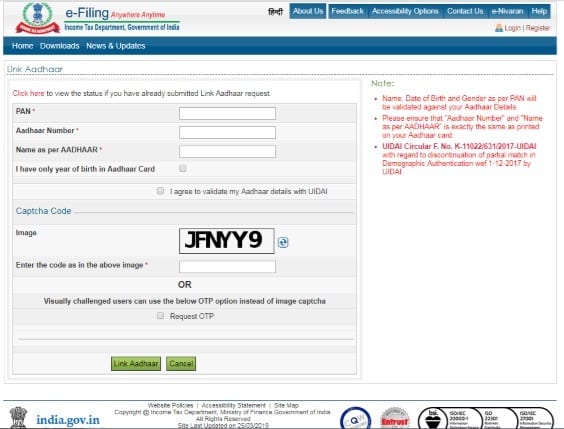

a) Open the Income Tax e-filing portal – https://incometaxindiaefiling.gov.in/

b) Register on it (if not already done). Your PAN (Permanent Account Number) will be your user id.

c) Log in by entering the User ID, password and date of birth.

d) A pop up window will appear, prompting you to link your PAN with Aadhaar. If not, go to ‘Profile Settings’ on Menu bar and click on ‘Link Aadhaar’.

e) Details such as name date of birth and gender will already be mentioned as per the PAN details.

f) Verify the PAN details on screen with the ones mentioned on your Aadhaar. Pls. note that if there is a mismatch, you need to get the same corrected in either of the documents.

g) If the details match, enter your Aadhaar number and click on the “link now” button.

h) A pop-up message will inform you that your Aadhaar has been successfully linked to your PAN

i) You may also visit https://www.utiitsl.com/ OR https://www.egov-nsdl.co.in/ to link your PAN and Aadhaar.

During filing Income Tax Return

A person can submit a request to link Aadhaar number with PAN while filing the income tax return (ITR) online (e-filing). The link of e-filing, according to the Income Tax Department, is available on the websites of NSDL (tin-nsdl.com) and UTIITSL (utiitsl.com), as well as the income tax e-filing portal.