Discover Online Privacy Protection : Is Discover Card Online Protection free?

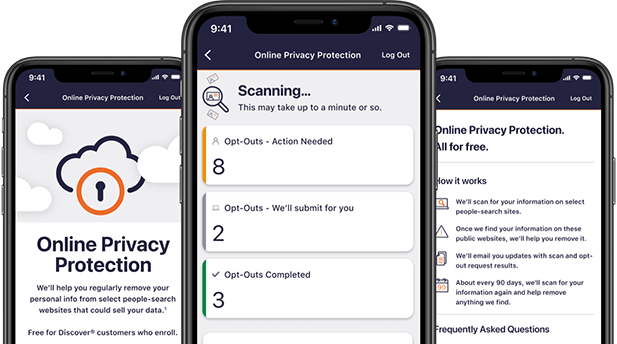

Learn about Online Privacy Protection, a no-cost programme that will systematically search 10 of the most common data-gathering websites and delete all of your personal information. This should result in fewer unwanted phone calls and emails. With just one swipe on your mobile device, you can sign up for Online Privacy Protection.

Each removal can help reduce your online privacy risk

Free Benefit

No hidden fees – it’s free for all Discover customers with the mobile app.

Recurring Scans

We’ll scan select people search sites for your information about every 90 days.

Easy Data Removal

We’ll submit opt-out requests that help remove your data if it’s publicly available at the select people-search sites.

Quick account access

Log in with Biometrics or your 4-digit passcode to check your balance, FICO® Credit Score and more.

Personalized notifications

Easily set up and manage mobile alerts on your phone. Get alerts on any device.

On-the-go payments

Pay your bills with just a few taps. It’s quick and easy, no matter where you are.

Online Privacy Protection is offered by Discover Bank at no cost and only available in the mobile app. Approximately every 90 days we will scan for your online personal information at 10 select people search sites and submit opt-out requests on your behalf. Types of personal information found on these sites will vary and may include your name, age, address, phone number and email address.

Intro purchase APR is 0% for 15 months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is 0% for 15 months from date of first transfer, for transfers under this offer that post to your account by January 10, 2023 then the standard purchase APR applies. Standard purchase APR: 14.99% variable to 25.99% variable, based on your creditworthiness. Cash APR: 27.99% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: 3% Intro fee on balances transferred by January 10, 2023 and up to 5% fee for future balance transfers will apply. Annual Fee: None. Rates as of September 30, 2022.

Be the first to comment