Code 766 On IRS Transcript 2022 : What does code 766 and 768 mean on IRS transcript?

Get more indepth details about the topic Code 766 On IRS Transcript 2022 : Code 766 with a date and amount is for a credit that is allowed. If OTN is next to it, however, that stands for Offset Trace Number.

Code 570 is for an additional liability pending and/or credit hold.

The IRS would be the agency that can provide the most accurate information as to any changes made based upon their review of your return.

However, based upon the attached list of codes, the following codes are used for the following purposes as listed.

- Code 806 indicates your return has a credit for income taxes and possibly excess FICA taxes withheld.

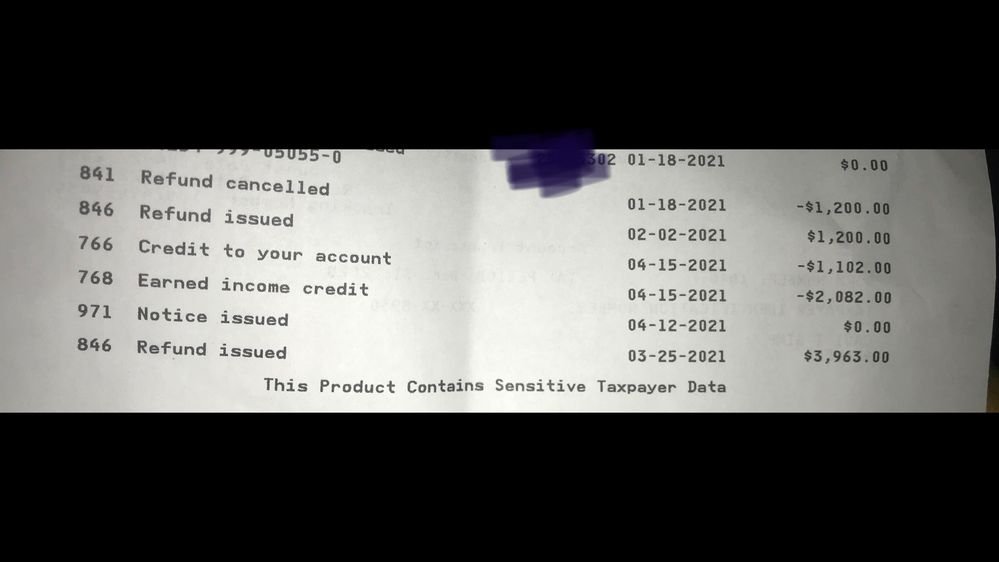

- Code 766 indicates your return has a refundable credit that could have been generated from various sources. Please see page 29 of the link below for more details on the types of credits included.

- Code 768 indicates there is an Earned Income Credit generated.

If the IRS does make any adjustments to your tax return, they will also notify you in writing of the changes and will give you instructions on how to reply if you disagree with their findings.

Transaction Codes

Code 806 is simply an acknowledgement that your electronically filed tax return was received.

Code 766 indicates a credit to your account (generally, a refund – but it can be a credit toward taxes in a prior year, if you have those)

Code 768 indicates an earned income credit amount

The dates on the transcript indicate the date those credits are effective in your file, which doesn’t necessarily correspond with a deposit date or the date a check is mailed, but deposit or mail dates are typically within a few days (on either side) of those dates.

Transaction Codes (TC) consist of three digits. They are used to identify a transaction being processed and to maintain a history of actions posted to a taxpayer’s account on the Master File. Every transaction processed by ADP must contain a Transaction Code to maintain Accounting Controls of debits and credits, to cause the computer at ECC to post the transaction on the Master File, to permit compilation of reports, and to identify the transaction when a transcript is extracted from the Master File.

Transaction codes that are unique to IDRS are also included. The definitions of several transaction codes are necessarily changed since there will be no resequencing, offsetting, or computer generated interest. In addition, all refunds will be scheduled manually with the refunds posted to the IMF using TC 840.

What does account balance mean on IRS transcript?

If the account reflects a balance due, the transcript provides the date to which any accrued penalty and interest were calculated.

What is a 806 tax code?

According to the official IRS master file codes, the transaction code 806 is a credit. What it means is that it credits the tax module for any withholding taxes and excess FICA claimed on the forms 1040 or 1041 return.

Does code 766 mean Im getting more money?

Transaction Code 766 issued on your transcript indicates a credit to your account. It is generally a refund, but it can be a credit toward taxes in a prior year if you have those

What does 846 refund issued mean?

Refund of overpayment

When you see the IRS code 846 (refund of overpayment) on your transcript it means a refund has been issued. This is when you can use the cycle code to get an estimated payment date for your refund. It will generally be the day after your “day of the week” cycle code

What is a 570 tax code?

Formally, according to the IRS pocket guide, TC 570 means your return is on hold due due to a pending additional liability. No further processing or refund payment can be made until this hold is lifted.