Published on Nov 30, 2023

Housing finance as a financial service is relatively young in India . The growth in housing and housing finance activities in recent years reflect the buoyant state of the housing finance market in India .

The real estate sector is the second largest employment generator in the country.

In 1970, the state set up the Housing and Urban Development Corporation (HUDCO) to finance housing and urban infrastructure activities, in 1977, the Housing Development Finance Corporation (HDFC) was the first housing finance company in the private sector to be set up in India .

Currently there are 29 HFCs approved for refinance assistance from NHB.

HUDCO is a powerful government organization. Financing state government for infrastructural development is the main aim. But ever since it has entered individual housing finance sector, the entire scenario has changed. The main war of interest rates has actually begun when HUDCO has started giving housing finance for 11.5 % and after deductions the interest rates comes to 8.81%.

After NHB, many housing finance companies looked at HUDCO for refinancing their proposals. Hometrust Ltd., a company by Gujarat Ambuja Group, Global Housing finance Ltd., a syndicate of reputed builders, Weizmann Homes Ltd., a company from Weizmann Finance Ltd., Maharishi Housing Finance Corporation Ltd., a company from Maharishi Group, are also catering to housing finance sector. SBI Home finance Ltd., a subsidiary of SBI, PNB Housing Finance Ltd., a subsidiary of PNB is also doing very good business. SBI Home Finance Ltd. is doing little bit slow for the time being but PNB Housing Finance Ltd. has recently opened its new branch near Shoppers Stop, Andheri. BOB Housing Finance Ltd., a subsidiary of Bank of Baroda also having very attractive housing finance schemes. Can Fin Homes, very aggressive subsidiary of Canara Bank in Southern India , is also doing very good job in Western parts of the country.

Nationalized banks are coming in a very big way into housing finance market. SBI, an oldest financial institution and bankers for majority of Indians have entered with interest rates of 12.24 %. PNB has crossed Rs. 50 crore alone in Mumbai region for housing finance in very short period of time.

Housing Development Finance Corporation Ltd (HDFC) is one of the leaders in the Indian housing finance market with almost 37% market share. Serves more than 26 lakh customers across the nation, HDFC also offers customized solutions that fit to the need of the customer. In the FY 2008, it registered a net profit of Rs. 2,282.54 crore. It also registered a net profit of Rs. 663.94 crore in the quarter ended September 30, 2009.

State Bank of India is another major player in the Indian housing finance market with almost 16% of the market share. The SBI Housing Loan schemes are specifically designed to meet the varied requirements of the customers. It offers home loan for various purposes including new house/flat, purchase of land, renovation/alteration/extension of existing house/flat etc. SBI Home Finance registered a net profit of Rs. 24.63 crore in the year ended March 31, 2009.

LIC Housing Finance is another major player in housing finance sector in India with almost 13% of market share. Promoted by Life Insurance Corporation of India, LICHFL has an extensive distribution network with a strong brand presence. Recently, the company has been awarded "Consumer Superbrand 2009/10 Status" by Superbrands Council. In the last financial year (ended on March 31, 2009), LICHFL earned a net profit of Rs. 387.19 crore, comparing to Rs. 279.14 in the previous FY. It also registered a net profit of Rs. 171.25 crore in the quarter ended on September 30, 2009.

ICICI is a leading housing finance company in India with almost 6% market share. It offers various types of home loans for its customers which may have tenure up to 20 years. The home loan interest rate is connected to the ICICI Bank Floating Reference Rate (FRR/PLR). Here it can be added here that, the PLR has been reduced to 14.75% from its previous rate of 15.25% since June 4, 2009. As on January 23, 2009, ICICI HFC has 1416 branches with an asset of Rs. 3,74,410 crore. As on December 31, 2008, the company has a net worth of Rs. 50,035 crore.

Dewan Housing Finance Corporation Limited is one of the largest housing finance solution providers in India with an extensive network of 74 branches, 78 service centers and 35 camps spread across the nation. The company registered a net profit of Rs. 8,631.83 lacs in 2008-09, comparing to a net profit of Rs. 8,257.74 lacs in the previous financial year. In the quarter ended on September 30, 2009, DHFL earned a profit (after tax) of Rs. 3,751.09 lacs.

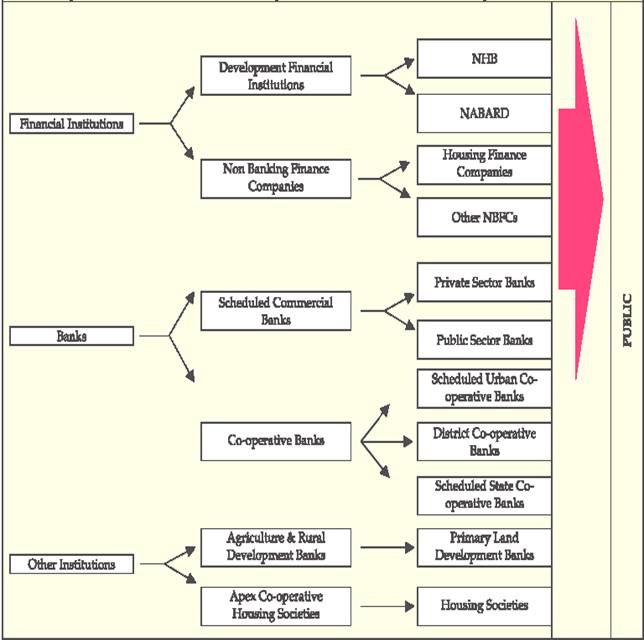

The following institutes are providing different Home Loan product to the different class of the people in the society and conduct the activity of financing and refinancing in the sector.

Scheduled Commercial Banks

Housing Finance Companies

Scheduled Cooperative Banks (Scheduled State Co-operative Banks, Scheduled District Cooperative Banks and Scheduled Urban Cooperative Banks)

Agriculture and Rural Development Banks

State Level Apex Co-operative Housing Finance Societies

www.bseindia.com for historical prices as on 20th January 2010.

www.cmie.com for M&A deals data collection as on 18th January 2010.

www.moneycontrol.com for news results as and when required.